While some toddlers take to it like a duck to water, potty training can be quite daunting for others. It’s a task that can sometimes be the source of considerable upset for little ones which, in turn, can be stressful for parents. However, with the right tools and some useful tips from experts and those who have already gone through the process, potty training can be plain sailing. With that in mind, today’s guide gathers together 20 top tips for successfully fast-tracking potty training — take a look!

Before we begin on the tips, though, let’s see what we should be expecting from our little ones:

When Should We Expect Children to Master Potty Training?

Children are all different. They learn and develop at different rates to each other and that applies to potty training success too. Circumstances in each family are different too, and this will also have an effect. In other words, there is no hard and fast rule about the age by which little ones should have mastered the use of the potty. Parents should therefore not worry if their child is slower to master toileting than their siblings or peers. That said, some very rough guidelines will always be useful to parents and these follow.

Children are all different. They learn and develop at different rates to each other and that applies to potty training success too. Circumstances in each family are different too, and this will also have an effect. In other words, there is no hard and fast rule about the age by which little ones should have mastered the use of the potty. Parents should therefore not worry if their child is slower to master toileting than their siblings or peers. That said, some very rough guidelines will always be useful to parents and these follow.

During the daytime, some tots will manage to stay mostly dry by the age of two to three, with most achieving it completely by the age of four. It’s a huge milestone when it finally happens!

During the night, most are also dry overnight by the age of six, although generally, infants will no longer poop at night even earlier — around the age of 12 months. That said, some children continue to wet the bed at night well beyond the age of 5 or 6. This can be for a variety of reasons, for example, simply because they sleep so deeply. They should never be told off about such incidents and minimal fuss should be made (they are, after all, accidents). The good news is that children are likely to grow out of bed-wetting anyway. We may follow up at a later date to write about measures families can take to minimise the likelihood of bed-wetting incidents for children over five.

20 Top Tips for Potty Training Success

Now we’ve outlined the key background information, it’s time for our 20 tips for potty training success.

- A good time to start your child on potty training is when they have shown that they’re aware of what’s in their nappy. Clues include looking in the nappy during a change, showing discomfort when in need of a change, or showing an awareness that they’re actually going to the loo.

- Beginning potty training during the warmer months of the year is also another top tip. That way, children will be wearing less clothes and what clothes they are wearing will be easier to dry on the washing line.

- Teach little ones all the appropriate words around the topic of potty training and toileting. By empowering them to use such language, they’re much better placed to ask to go to the loo in good time.

- Try rewarding your child for successful use of the potty. The promise of a treat for a successful ‘number two’ can often be all that’s needed to convince a reticent child to attempt it on the potty. Colourful reward stickers and a toileting chart celebrating successes also encourage children.

- When a number one or two are each achieved, especially early on in their potty training, celebrate and congratulate your child — these are huge milestones! Giving them praise will encourage them to build on their success.

Allowing your toddler to help choose their potty can automatically make it less daunting and instead more of a ‘friendly’ thing to have in their life.

Allowing your toddler to help choose their potty can automatically make it less daunting and instead more of a ‘friendly’ thing to have in their life.- Potties and toileting accessories that feature your child’s favourite characters, for example, dinosaurs, unicorns, or TV characters, will also make them much more friendly and even fun to the little one.

- Indeed, choosing the ‘right’ potty and toileting accessories is important on many levels. There are many different kinds to choose from, each suitable for different circumstances and preferences, including:

Portable potties for when you’re out and about (some even come in a travel case format with wheels). Training seats that attach to an adult toilet. Musical potties that activate a song when they’ve sensed a successful use; these are great for children to sing along to and doing so will encourage them. A set of suitable steps will also help little ones get themselves to the right height once they’ve progressed from a potty to a toilet. These are also useful for reaching adult-level sinks to wash their hands.  Children can also be encouraged by having their own toy potties. They, and parents, can ‘train’ teddies and dolls to use these during play. Doing so will help them be both relaxed and more educated about potty training — even proactive.

Children can also be encouraged by having their own toy potties. They, and parents, can ‘train’ teddies and dolls to use these during play. Doing so will help them be both relaxed and more educated about potty training — even proactive.- Parents can also source potty training-themed books, stories, songs, YouTube videos and even games that will help children engage in the potty-training process whilst also making it fun.

- When potty training first begins, it’s a great idea to encourage your toddler to visit the potty at initially short, regular intervals. This could be every 30 minutes at the start but can be gradually extended to longer intervals once the child is showing signs of success.

- Ensure your child tries to use the potty immediately before bedtime, of course, and when they wake up from any period of sleep (day or night). It’s also a good idea to encourage them to use it after meals.

- When progressing away from using nappies, the use of ‘pull-ups’ is a good tool for the transition. Pull-ups are midway between a nappy and traditional underwear and, as such, will both protect and get children used to not wearing nappies.

- When starting potty training, picking a quiet time will help children focus, so they do not get distracted or put off.

- Setting a toileting schedule that doesn’t conflict with other items in your child’s routine will also help. Sticking to such a schedule will get little ones used to using the potty — and indeed they’ll expect to do so.

Don’t forget to make potty training fun! Many of these tips will help towards that, including the rewards idea (#4), praise (#5), characters on potties (#7), toileting-themed music (#8), and so on.

Don’t forget to make potty training fun! Many of these tips will help towards that, including the rewards idea (#4), praise (#5), characters on potties (#7), toileting-themed music (#8), and so on.- Normalise the whole process. The last thing potty training needs to be perceived as is a ‘problem’, so making it just a normal part of everyday life is essential to success.

- Let them know that their friends or peers are also potty training (or trained). Ensure children know that you also went through the process of potty training, as did older siblings, friends, and relatives. In this way, they won’t be made to feel ‘different’ or that something is ‘wrong’.

- Keep calm in front of your child even if they begin to get stressed during potty training or toileting. Don’t let them hear anything negative about potty training, including any accidents, which will happen however swimmingly the training goes.

- Remember that part of potty training is also teaching your child good hygiene practices including the need to always wash hands after use of the potty or toilet. They need to understand that this is essential for their health,

household cleanliness, and for their independence.

household cleanliness, and for their independence.

With successful potty training comes an easier home life for parents, improved cleanliness and hygiene for children and, with no nappies to buy, less household expense. Mastering potties and later the toilet will also be a huge boost to children’s independence and self-confidence; both being hugely important at nursery/preschool and, in particular, when they begin school.

Our Nursery in Streatham, London SW16

Little Cedars Nursery: High-Quality Childcare Services in Streatham

We hope that today’s potty training tips help to make the process go smoothly. We are Little Cedars Nursery in Streatham, London SW16, situated conveniently close to Furzedown, Tooting, Norbury, Balham, and Colliers Wood. As a Good Provider of early years childcare, we give babies, toddlers, and preschoolers under 5 the very best start in life. We bring out the best in them, so they’re ready to hit the ground running by the time they start school. We also support many of the Government’s free childcare schemes to make it more affordable for eligible families.

Contact Little Cedars Nursery today to register your child for a childcare place, ask a question, or book a free tour of the setting:

As promised in our last post we now extend our

As promised in our last post we now extend our  One of the key things that pollinators like bees need is something to drink, particularly when the weather is hot. They expend a lot of energy buzzing about and can easily become exhausted without a source of water. So, a simple thing that children and families can do is to put out some small, shallow dishes of water among any flowers (whether in flowerbeds or flowerpots). The little drip trays that you put under flowerpots are perfect but any small, shallow dish will do. A critically important detail is that a ‘landing stone’ should be placed into the water so that the bees have somewhere safe to land above the level of the water’s surface.

One of the key things that pollinators like bees need is something to drink, particularly when the weather is hot. They expend a lot of energy buzzing about and can easily become exhausted without a source of water. So, a simple thing that children and families can do is to put out some small, shallow dishes of water among any flowers (whether in flowerbeds or flowerpots). The little drip trays that you put under flowerpots are perfect but any small, shallow dish will do. A critically important detail is that a ‘landing stone’ should be placed into the water so that the bees have somewhere safe to land above the level of the water’s surface.  Bees, hoverflies, butterflies and all pollinators also need nectar as a food source. For our children, that means that flowers — and their pollen — are the key to attracting them. So, with adult supervision, children can sow pollinator-attracting flowers from things like poppy seeds and wildflower seed mixes. These are readily available commercially, are usually marked on the packets as pollinator-friendly, and are usually very inexpensive. They’re also easy to grow (see our

Bees, hoverflies, butterflies and all pollinators also need nectar as a food source. For our children, that means that flowers — and their pollen — are the key to attracting them. So, with adult supervision, children can sow pollinator-attracting flowers from things like poppy seeds and wildflower seed mixes. These are readily available commercially, are usually marked on the packets as pollinator-friendly, and are usually very inexpensive. They’re also easy to grow (see our  As we mentioned above, butterflies will be attracted to flowers like poppies and wildflowers. However, they absolutely love flowering Buddleia (right) and Hylotelephium (a.k.a. ‘Ice Plant’ – see main image at top), especially if they’re located in a sunny position. On a good day, children may find such plants absolutely covered with visiting butterflies and other pollinators — and these creatures are a delight for little ones and adults alike. Note, though, that parents will need to hard prune most Buddleia varieties in early Spring, otherwise, they can grow quite large. If space is limited, therefore, stick with poppies, wildflowers, and ice plants rather than buddleia.

As we mentioned above, butterflies will be attracted to flowers like poppies and wildflowers. However, they absolutely love flowering Buddleia (right) and Hylotelephium (a.k.a. ‘Ice Plant’ – see main image at top), especially if they’re located in a sunny position. On a good day, children may find such plants absolutely covered with visiting butterflies and other pollinators — and these creatures are a delight for little ones and adults alike. Note, though, that parents will need to hard prune most Buddleia varieties in early Spring, otherwise, they can grow quite large. If space is limited, therefore, stick with poppies, wildflowers, and ice plants rather than buddleia. As well as enjoying the nectar from the flowers that children have planted (see above), butterflies can also be lured to children’s gardens through a kind of drink that’s also food for them. For butterflies, children simply mix up to four parts of warmed water with one part of sugar. Stir until the sugar has dissolved. Children can then drizzle the sweet solution over small slices of ripe fruit or even small cut-up pieces of a clean sponge. As with the water for the bees, these can then be placed in shallow dishes and left among flowerbeds or alongside flowerpots on a balcony or windowsill. Once they’ve discovered them, butterflies will soon begin to land to sip at this sweet food supply. Children will then be able to see their incredible beauty up close.

As well as enjoying the nectar from the flowers that children have planted (see above), butterflies can also be lured to children’s gardens through a kind of drink that’s also food for them. For butterflies, children simply mix up to four parts of warmed water with one part of sugar. Stir until the sugar has dissolved. Children can then drizzle the sweet solution over small slices of ripe fruit or even small cut-up pieces of a clean sponge. As with the water for the bees, these can then be placed in shallow dishes and left among flowerbeds or alongside flowerpots on a balcony or windowsill. Once they’ve discovered them, butterflies will soon begin to land to sip at this sweet food supply. Children will then be able to see their incredible beauty up close.  Putting out food suitable for birds is the most simple way to attract birds to a child’s garden or outdoor space. Once the birds recognise and trust it, the new food source will provide a regular stream of pretty, feathered visitors. Children will love knowing they helped to attract these wonderful creatures and have been responsible for giving them a much-needed meal. They can also use

Putting out food suitable for birds is the most simple way to attract birds to a child’s garden or outdoor space. Once the birds recognise and trust it, the new food source will provide a regular stream of pretty, feathered visitors. Children will love knowing they helped to attract these wonderful creatures and have been responsible for giving them a much-needed meal. They can also use  Commercially available ‘Robin peanut cakes’ and ‘sunflower hearts’ are also a big hit with many birds, and can usually be found in supermarkets or online. Whole bird-friendly peanuts are also popular with birds like bluetits and great tits, however, can be a choking hazard for baby birds during the breeding season if not crushed into tiny pieces. More information about suitable food types for birds can be found using the link in the paragraph above.

Commercially available ‘Robin peanut cakes’ and ‘sunflower hearts’ are also a big hit with many birds, and can usually be found in supermarkets or online. Whole bird-friendly peanuts are also popular with birds like bluetits and great tits, however, can be a choking hazard for baby birds during the breeding season if not crushed into tiny pieces. More information about suitable food types for birds can be found using the link in the paragraph above. Birds need to drink and bathe themselves, so putting out water in shallow vessels like flowerpot saucers will be welcomed by them. These are best located somewhere a little secluded, e.g. in amongst flowers in a flowerbed or below overhanging shrubs or trees, rather than right out in the open. Otherwise, birds may avoid them as they’ll feel unsafe from birds of prey that sometimes view from high up in the air. If bird baths supplied are on the larger side, birds may bathe in them as well as drink from them. That’s a delight for children to see, so encourage your little one to make one or more bird baths available but also make sure of several things:

Birds need to drink and bathe themselves, so putting out water in shallow vessels like flowerpot saucers will be welcomed by them. These are best located somewhere a little secluded, e.g. in amongst flowers in a flowerbed or below overhanging shrubs or trees, rather than right out in the open. Otherwise, birds may avoid them as they’ll feel unsafe from birds of prey that sometimes view from high up in the air. If bird baths supplied are on the larger side, birds may bathe in them as well as drink from them. That’s a delight for children to see, so encourage your little one to make one or more bird baths available but also make sure of several things: Children will also love seeing birds moving into birdhouses, which families can either make or buy, often inexpensively, and put up around gardens or properties. There are lots of different kinds, for example, blue tit boxes have a hole as an entrance whereas robins require a larger opening. Some research online may be wise and families can decide which type to go for based on what species of birds they wish to attract.

Children will also love seeing birds moving into birdhouses, which families can either make or buy, often inexpensively, and put up around gardens or properties. There are lots of different kinds, for example, blue tit boxes have a hole as an entrance whereas robins require a larger opening. Some research online may be wise and families can decide which type to go for based on what species of birds they wish to attract. By far the best way to attract minibeasts, apart from ensuring harmful weedkillers and other nasty chemicals aren’t used around the garden, is to give them a compost heap to live in. Such places will attract minibeasts like centipedes, woodlice, millipedes, worms and many other types — perhaps even slow worms. Building a compost heap is a wonderfully worthwhile, fun, and educational activity for children to take part in and our

By far the best way to attract minibeasts, apart from ensuring harmful weedkillers and other nasty chemicals aren’t used around the garden, is to give them a compost heap to live in. Such places will attract minibeasts like centipedes, woodlice, millipedes, worms and many other types — perhaps even slow worms. Building a compost heap is a wonderfully worthwhile, fun, and educational activity for children to take part in and our  Aside from that, minibeasts and many other types of garden visitors love a wild area of the garden or outdoor space to live in, ideally with ramshackle things like flower pots, rocks, piles of rotting leaves, and rotting logs/branches for bugs, slow worms and other minibeasts to live under. Lizards, frogs, and toads may also be attracted to such areas, particularly if the area is kept damp.

Aside from that, minibeasts and many other types of garden visitors love a wild area of the garden or outdoor space to live in, ideally with ramshackle things like flower pots, rocks, piles of rotting leaves, and rotting logs/branches for bugs, slow worms and other minibeasts to live under. Lizards, frogs, and toads may also be attracted to such areas, particularly if the area is kept damp. Make or buy a ‘bug hotel’ and place this in the wilderness area too, as it’ll provide a home for all sorts of bugs and insects, including some pollinators like solitary bees, bumblebees, and other minibeasts like ladybirds, woodlice, snails, spiders — even some types of butterfly potentially. Indeed, bug hotels are excellent in autumn as they will provide somewhere safe for the creatures to over-winter and hibernate. The RSPB has

Make or buy a ‘bug hotel’ and place this in the wilderness area too, as it’ll provide a home for all sorts of bugs and insects, including some pollinators like solitary bees, bumblebees, and other minibeasts like ladybirds, woodlice, snails, spiders — even some types of butterfly potentially. Indeed, bug hotels are excellent in autumn as they will provide somewhere safe for the creatures to over-winter and hibernate. The RSPB has  With the right preparation and if children are really lucky, they may even find that adorable little hedgehogs pay a visit. Better still, they may even move in under and raise families of adorable baby hedgehogs if the circumstances are right. Piles of leaves in wild areas, compost heaps in garden corners, unlit bonfire wood stacks, beneath sheds and where there are leaves collecting under undergrowth are all great areas for hedgehogs to stay, particularly if they’re secluded and peaceful areas away from noise, activity, and garden pets like dogs and cats. Ensuring there is a suitable gap under garden fences will also allow hedgehogs to come and go as they please, to forage for food. Ensure they’re not too big, though, if you have a pet.

With the right preparation and if children are really lucky, they may even find that adorable little hedgehogs pay a visit. Better still, they may even move in under and raise families of adorable baby hedgehogs if the circumstances are right. Piles of leaves in wild areas, compost heaps in garden corners, unlit bonfire wood stacks, beneath sheds and where there are leaves collecting under undergrowth are all great areas for hedgehogs to stay, particularly if they’re secluded and peaceful areas away from noise, activity, and garden pets like dogs and cats. Ensuring there is a suitable gap under garden fences will also allow hedgehogs to come and go as they please, to forage for food. Ensure they’re not too big, though, if you have a pet.

National Children’s Gardening Week takes place each year in the UK during what’s known as the ‘warm week’ beginning right at the end of May. This year (2024) it spans from 25 May to 2 June. However, children can get involved in gardening well outside of those dates*, of course.

National Children’s Gardening Week takes place each year in the UK during what’s known as the ‘warm week’ beginning right at the end of May. This year (2024) it spans from 25 May to 2 June. However, children can get involved in gardening well outside of those dates*, of course. This year (2024), National Children’s Gardening Week has teamed up with The World of Peter Rabbit and is encouraging children and their families to Grow With Peter Rabbit!

This year (2024), National Children’s Gardening Week has teamed up with The World of Peter Rabbit and is encouraging children and their families to Grow With Peter Rabbit!

Did you know, there are some incredibly

Did you know, there are some incredibly

Compost heaps are also wonderful homes for minibeasts, which are also fun and educational for children to spot. Use our previously published

Compost heaps are also wonderful homes for minibeasts, which are also fun and educational for children to spot. Use our previously published  So, making a wildlife-friendly garden or area is a very worthwhile activity for children to take part in — and is educational on so many levels. See

So, making a wildlife-friendly garden or area is a very worthwhile activity for children to take part in — and is educational on so many levels. See  Children can do ‘gardening’ activities indoors too! Get them to

Children can do ‘gardening’ activities indoors too! Get them to  The benefits of gardening for children are many and varied and that’s why it’s such a wonderful activity to get them involved in. It will teach children many new skills and new knowledge. It’ll teach them about the circle of life, how to care and be responsible for other living things, and about the importance of looking after the planet. It will also give them an insight into where some food types come from. It is also great fun, will give children a huge sense of achievement, and may even open their eyes to the possibility of careers in horticulture, land management, food production, farming, and the like. And, of course, gardening makes the world a better place in so many ways. Let’s also not forget that

The benefits of gardening for children are many and varied and that’s why it’s such a wonderful activity to get them involved in. It will teach children many new skills and new knowledge. It’ll teach them about the circle of life, how to care and be responsible for other living things, and about the importance of looking after the planet. It will also give them an insight into where some food types come from. It is also great fun, will give children a huge sense of achievement, and may even open their eyes to the possibility of careers in horticulture, land management, food production, farming, and the like. And, of course, gardening makes the world a better place in so many ways. Let’s also not forget that

As we previously reported,

As we previously reported,  One of the ways you can optimise the success of any indoor play is to set aside a dedicated and safe play area or room for your child. Here, you can ensure that children have the space and tools available for stimulating play when needed, and quieter play at other times. Age-appropriate toys, books, and equipment are, of course, the first prerequisite for such an area. However, you may also consider other elements such as a quiet storytelling/reading corner, a play den or teepee, a relaxation area with cushions and blankets, a creative section with art and craft supplies, a play kitchen or play tools section, and so on. Giving your child such a space is sure to encourage them to immerse themselves in their play activities. And, as we know, children learn best through play.

One of the ways you can optimise the success of any indoor play is to set aside a dedicated and safe play area or room for your child. Here, you can ensure that children have the space and tools available for stimulating play when needed, and quieter play at other times. Age-appropriate toys, books, and equipment are, of course, the first prerequisite for such an area. However, you may also consider other elements such as a quiet storytelling/reading corner, a play den or teepee, a relaxation area with cushions and blankets, a creative section with art and craft supplies, a play kitchen or play tools section, and so on. Giving your child such a space is sure to encourage them to immerse themselves in their play activities. And, as we know, children learn best through play. As well as giving children the tools for imaginative and educational play at home, your proactive input will also boost the benefits they receive from such activities. So, get involved, lead them sometimes and at other times let them lead. They’ll discover and learn more in this way. Ask and answer questions, encourage them to be creative in their thinking and physical approach and highlight aspects and elements that they may not otherwise have been aware of. Such an approach can teach children so much. It may well also deepen the bond between you.

As well as giving children the tools for imaginative and educational play at home, your proactive input will also boost the benefits they receive from such activities. So, get involved, lead them sometimes and at other times let them lead. They’ll discover and learn more in this way. Ask and answer questions, encourage them to be creative in their thinking and physical approach and highlight aspects and elements that they may not otherwise have been aware of. Such an approach can teach children so much. It may well also deepen the bond between you. There are many types of play at home that can involve role-play, which is a powerful tool for learning. Role-play allows children to immerse themselves deeply into the game, story, or scenario they are acting out. As such it greatly boosts young imaginations and stimulates creativity skills. So, encourage such activities as dressing up in costumes, acting, and putting on pretend voices to embody characters. You and your child can take this a step further through the setting up of play equipment or props to create a new play scenario, for example, a play den, cave, pretend kitchen, or castle. Children will have immense fun whilst also learning huge amounts from such creative and imaginative activities.

There are many types of play at home that can involve role-play, which is a powerful tool for learning. Role-play allows children to immerse themselves deeply into the game, story, or scenario they are acting out. As such it greatly boosts young imaginations and stimulates creativity skills. So, encourage such activities as dressing up in costumes, acting, and putting on pretend voices to embody characters. You and your child can take this a step further through the setting up of play equipment or props to create a new play scenario, for example, a play den, cave, pretend kitchen, or castle. Children will have immense fun whilst also learning huge amounts from such creative and imaginative activities. Role-playing can also be brought into time spent reading with your child.

Role-playing can also be brought into time spent reading with your child.  While electronic screens have their occasional place in the education and entertainment of families, it’s healthy to ensure your child has regular screen-free time. Partaking in active play at home — rather than staring inactively at a screen — can only be a good thing, in so many ways. Social skills will be better when children are actively involved in physical play with others. Motor skills and fitness will also benefit. Creativity levels will go through the roof too when children play in real life. They will also learn so much about the world, everything around them and the endless possibilities available to them by playing in the real world. Ensuring children get access to such benefits and opportunities by switching off smartphones, TVs, tablets and game consoles is something every parent can easily do for their child. Doing so will allow for more traditional play, which will enrich their lives in an infinite number of ways.

While electronic screens have their occasional place in the education and entertainment of families, it’s healthy to ensure your child has regular screen-free time. Partaking in active play at home — rather than staring inactively at a screen — can only be a good thing, in so many ways. Social skills will be better when children are actively involved in physical play with others. Motor skills and fitness will also benefit. Creativity levels will go through the roof too when children play in real life. They will also learn so much about the world, everything around them and the endless possibilities available to them by playing in the real world. Ensuring children get access to such benefits and opportunities by switching off smartphones, TVs, tablets and game consoles is something every parent can easily do for their child. Doing so will allow for more traditional play, which will enrich their lives in an infinite number of ways. Toys that allow open-ended play are the toys that young children will usually learn the most from. For example, allowing your child to play with building blocks and materials for arts and crafts will let your child’s imagination run riot. Through these, they will be able to create an infinite range of scenarios and possibilities. Dolls and action figures are also good examples that will allow children to immerse themselves in open-ended play, with you there to help expand those possibilities, scenarios and learning opportunities even further.

Toys that allow open-ended play are the toys that young children will usually learn the most from. For example, allowing your child to play with building blocks and materials for arts and crafts will let your child’s imagination run riot. Through these, they will be able to create an infinite range of scenarios and possibilities. Dolls and action figures are also good examples that will allow children to immerse themselves in open-ended play, with you there to help expand those possibilities, scenarios and learning opportunities even further. It doesn’t have to be just you and your child playing. Siblings and your child’s peers can also be encouraged to join in. Consider inviting your little one’s friends to your home or local park for a play date. Getting your child’s friends and peers together for group play will allow your child to learn and hone social skills like cooperation, teamwork, leadership, sharing and potentially even conflict resolution. And, with you there to oversee the group session, you can be sure that home play will be fulfilling, organised, fair and rewarding for all who take part.

It doesn’t have to be just you and your child playing. Siblings and your child’s peers can also be encouraged to join in. Consider inviting your little one’s friends to your home or local park for a play date. Getting your child’s friends and peers together for group play will allow your child to learn and hone social skills like cooperation, teamwork, leadership, sharing and potentially even conflict resolution. And, with you there to oversee the group session, you can be sure that home play will be fulfilling, organised, fair and rewarding for all who take part. Remember that you can facilitate learning through play outdoors with your child too. Whether in the garden, park or countryside, playing outdoors gives children a vast number of learning opportunities — and it’s great fun! By accompanying children outdoors, they can naturally explore and discover — and enjoy doing so in ways that are much more free than when playing indoors. Outdoor play is a feast for the senses, it will encourage the honing of physical skills like balance, coordination, motor skills and strength as well as fitness. Playing in the natural world is also incredibly good for children’s mental well-being and holistic development. Learn more about

Remember that you can facilitate learning through play outdoors with your child too. Whether in the garden, park or countryside, playing outdoors gives children a vast number of learning opportunities — and it’s great fun! By accompanying children outdoors, they can naturally explore and discover — and enjoy doing so in ways that are much more free than when playing indoors. Outdoor play is a feast for the senses, it will encourage the honing of physical skills like balance, coordination, motor skills and strength as well as fitness. Playing in the natural world is also incredibly good for children’s mental well-being and holistic development. Learn more about

Autumn is a magical time filled with vibrant colours, falling leaves, and a wonderful quality to the air. With rustling leaves covering the ground in a myriad of hues, it’s the perfect season to engage children with the wonders of a composting activity. Composting is fun, worthwhile, and educational. It not only teaches kids about the importance of recycling and sustainability but also provides an exciting outdoor activity that connects them with nature. In today’s article, we’ll explore the joy of composting with an autumn twist, where children can harness the abundance of fallen leaves to create a rich and fertile compost for the garden. Children of all ages will love this nature-based outdoor activity and it’s a win-win in every sense — for children, nature’s flora and fauna, and the garden itself.

Autumn is a magical time filled with vibrant colours, falling leaves, and a wonderful quality to the air. With rustling leaves covering the ground in a myriad of hues, it’s the perfect season to engage children with the wonders of a composting activity. Composting is fun, worthwhile, and educational. It not only teaches kids about the importance of recycling and sustainability but also provides an exciting outdoor activity that connects them with nature. In today’s article, we’ll explore the joy of composting with an autumn twist, where children can harness the abundance of fallen leaves to create a rich and fertile compost for the garden. Children of all ages will love this nature-based outdoor activity and it’s a win-win in every sense — for children, nature’s flora and fauna, and the garden itself. Autumn leaves are rather like nature’s confetti and they play a crucial role in composting. Perhaps explain to children how leaves provide essential carbon and nutrients that are key ingredients for a successful compost pile. Encourage them to collect a variety of leaves in different colours and shapes, so this activity becomes a stimulating treasure hunt too.

Autumn leaves are rather like nature’s confetti and they play a crucial role in composting. Perhaps explain to children how leaves provide essential carbon and nutrients that are key ingredients for a successful compost pile. Encourage them to collect a variety of leaves in different colours and shapes, so this activity becomes a stimulating treasure hunt too. Guide children in setting up a compost bin or, in its most basic form, it could take the form of a simple pile in the garden if you have one. If not, an undisturbed corner somewhere outside will suffice. Emphasise the importance of a balanced mix of green (nitrogen-rich) and brown (carbon-rich) materials. Leaves are a fantastic source of carbon, balancing out the kitchen scraps and other green materials that you and your child may soon start to add.

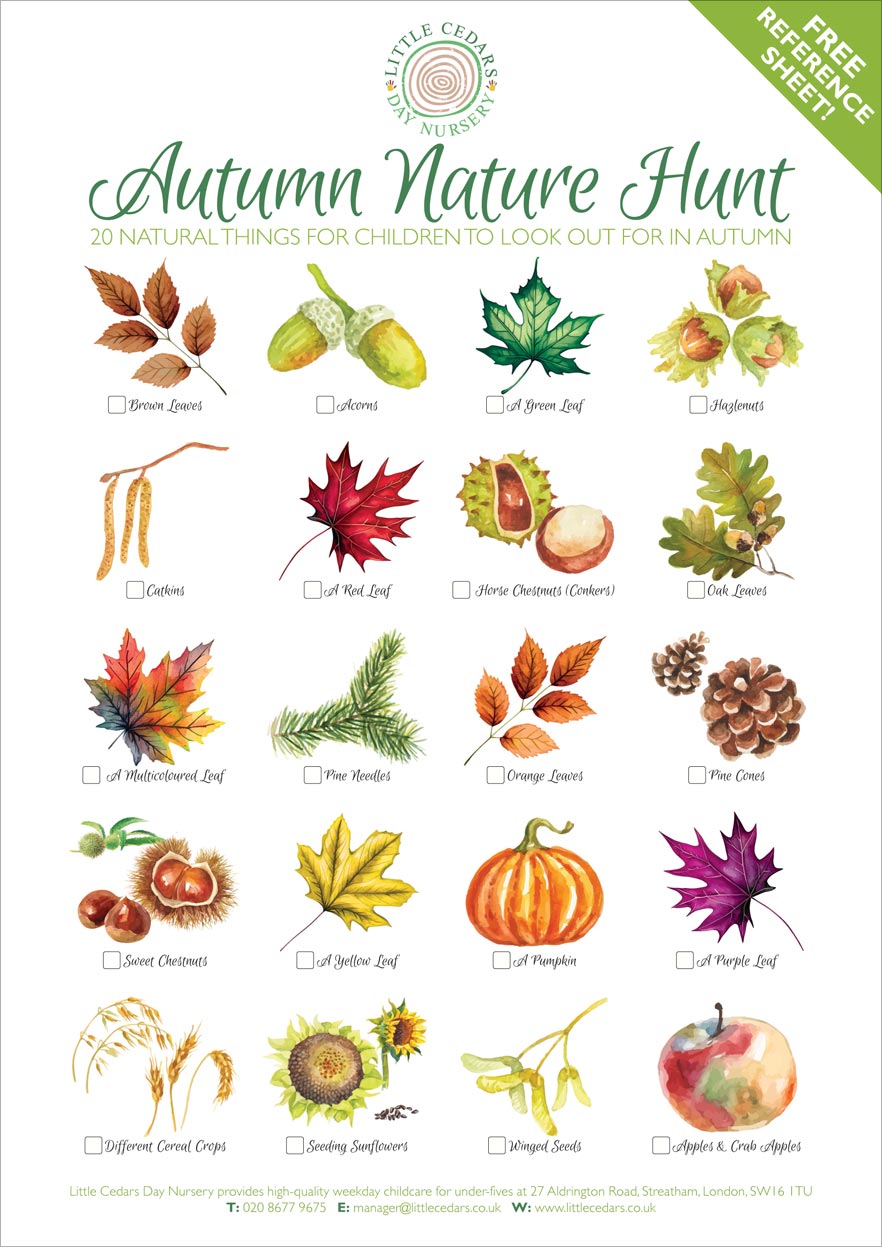

Guide children in setting up a compost bin or, in its most basic form, it could take the form of a simple pile in the garden if you have one. If not, an undisturbed corner somewhere outside will suffice. Emphasise the importance of a balanced mix of green (nitrogen-rich) and brown (carbon-rich) materials. Leaves are a fantastic source of carbon, balancing out the kitchen scraps and other green materials that you and your child may soon start to add. To make composting even more enjoyable, you and the children could incorporate other autumn-themed activities. For example, they could create leaf art while waiting for the compost to develop, they could decorate the compost container through painting, or they could take part in

To make composting even more enjoyable, you and the children could incorporate other autumn-themed activities. For example, they could create leaf art while waiting for the compost to develop, they could decorate the compost container through painting, or they could take part in

Autumn is a time of the year when magical colour changes occur across gardens, parks and landscapes. Leaves can be seen in a multitude of different colours before falling along with seeds, ripening fruits and berries. In autumn, nature shows us a wonderful metamorphosis and it’s a time of beautifully crisp air and clear distant views. It’s all incredible to behold and also offers children some unique seasonal activity opportunities.

Autumn is a time of the year when magical colour changes occur across gardens, parks and landscapes. Leaves can be seen in a multitude of different colours before falling along with seeds, ripening fruits and berries. In autumn, nature shows us a wonderful metamorphosis and it’s a time of beautifully crisp air and clear distant views. It’s all incredible to behold and also offers children some unique seasonal activity opportunities.

The arrival of October means it’s time for children and families to prepare for Halloween! Arriving on the 31st of the month, it’s a firm favourite for any childhood and gives children the opportunity for uniquely spooky fun, games and dressing up. Indeed, Halloween offers a wonderful variety of activities for children to take part in and that’s exactly what we look at in today’s article. Stand by, then, to prepare the household for some spookylicious Halloween activity ideas for kids!

The arrival of October means it’s time for children and families to prepare for Halloween! Arriving on the 31st of the month, it’s a firm favourite for any childhood and gives children the opportunity for uniquely spooky fun, games and dressing up. Indeed, Halloween offers a wonderful variety of activities for children to take part in and that’s exactly what we look at in today’s article. Stand by, then, to prepare the household for some spookylicious Halloween activity ideas for kids! Children adore dressing up for Halloween. The spooky nature of Halloween costumes really appeals to them, especially if they get together with friends and compare outfits on Halloween evening.

Children adore dressing up for Halloween. The spooky nature of Halloween costumes really appeals to them, especially if they get together with friends and compare outfits on Halloween evening. Similarly, black sheets are easy to make into witch or wizard outfits. Alternatively, use black clothing and, if it’s no longer being worn for anything else, it can even be given ragged edges for extra effect. Add pointy black hats made of cardboard or paper and the costumes are complete.

Similarly, black sheets are easy to make into witch or wizard outfits. Alternatively, use black clothing and, if it’s no longer being worn for anything else, it can even be given ragged edges for extra effect. Add pointy black hats made of cardboard or paper and the costumes are complete. If you want your child’s Halloween experience to be truly spooktacular, encourage them to decorate the house – whether inside or out – with all manner of ghoulish decorations and ghostly paraphernalia. Home-made spider webs can, of course, be made using string, thread or stretched-out cotton wool. However, such decorations can usually be purchased inexpensively from supermarkets, which typically have cheap Halloween decorations around October each year. Spiders can be home-made by children from wool or black pipe cleaners, or similarly bought commercially along with shop-bought decorations depicting skeletons, ghosts, bats and suchlike. You can also buy LED lights, including strings of lights, that look like Halloween pumpkin lanterns. Such lighting is great for extra atmosphere!

If you want your child’s Halloween experience to be truly spooktacular, encourage them to decorate the house – whether inside or out – with all manner of ghoulish decorations and ghostly paraphernalia. Home-made spider webs can, of course, be made using string, thread or stretched-out cotton wool. However, such decorations can usually be purchased inexpensively from supermarkets, which typically have cheap Halloween decorations around October each year. Spiders can be home-made by children from wool or black pipe cleaners, or similarly bought commercially along with shop-bought decorations depicting skeletons, ghosts, bats and suchlike. You can also buy LED lights, including strings of lights, that look like Halloween pumpkin lanterns. Such lighting is great for extra atmosphere! If your household is carving pumpkins for Halloween this year, perhaps save some of the flesh and use it to make a spookylicious pumpkin soup for the family to eat come Halloween evening time. There are plenty of excellent recipes online and children can help make the soup, under supervision for safety purposes.

If your household is carving pumpkins for Halloween this year, perhaps save some of the flesh and use it to make a spookylicious pumpkin soup for the family to eat come Halloween evening time. There are plenty of excellent recipes online and children can help make the soup, under supervision for safety purposes. Children can combine Halloween fancy dress costumes, spooky decorations, and themed food and drink by hosting a Halloween party for friends and family. Such preparations are sure to set up a wonderfully spooky atmosphere in which children will have immense fun comparing outfits and getting into the spirit of the event. Add Halloween-themed games, play ghostly music and take turns to read ghost stories and the evening is sure to be one to remember! It’s also a great conduit through which children can socialise and perhaps grow stronger bonds.

Children can combine Halloween fancy dress costumes, spooky decorations, and themed food and drink by hosting a Halloween party for friends and family. Such preparations are sure to set up a wonderfully spooky atmosphere in which children will have immense fun comparing outfits and getting into the spirit of the event. Add Halloween-themed games, play ghostly music and take turns to read ghost stories and the evening is sure to be one to remember! It’s also a great conduit through which children can socialise and perhaps grow stronger bonds. Take the Halloween activities to an extra level by arranging a group trick-or-treat session, under adult supervision, for children in your street. They will absolutely love this activity and it’s sure to result in much giggling and laughter if it goes as planned. However, be sure to check with each neighbour before the day. In that way, they can opt out if they prefer not to get involved. For those that do take part, most neighbours usually go the ‘treat’ route but be ready for the possibility that a few may opt for the ‘trick’ option, in which scenario the children under your supervision will need to be ready with a fun but harmless trick. Some forethought and creative thinking may be needed there, with care being taken not to allow children to overstep the mark.

Take the Halloween activities to an extra level by arranging a group trick-or-treat session, under adult supervision, for children in your street. They will absolutely love this activity and it’s sure to result in much giggling and laughter if it goes as planned. However, be sure to check with each neighbour before the day. In that way, they can opt out if they prefer not to get involved. For those that do take part, most neighbours usually go the ‘treat’ route but be ready for the possibility that a few may opt for the ‘trick’ option, in which scenario the children under your supervision will need to be ready with a fun but harmless trick. Some forethought and creative thinking may be needed there, with care being taken not to allow children to overstep the mark. Pumpkin patches are often wonderful places for children and families to spend a few hours in the run-up to Halloween. In such places, your little one can explore amongst hundreds of pumpkins and other gourds of different sizes and shapes. And, if they find one they take a liking to, they can usually be purchased to take home, or might even be included in the price if the venue has an entrance fee. Pumpkin patches often also have other Halloween-themed activities at this time of year, whether it’s displays where you can take memorable snaps of your child amongst the pumpkins, wheelbarrow rides for children across a pumpkin field, pop-up refreshments with Halloween-themed food and drink or pumpkin-decorating workshops, they’re always great fun for children. They really help to make Halloween the special time of year that it is.

Pumpkin patches are often wonderful places for children and families to spend a few hours in the run-up to Halloween. In such places, your little one can explore amongst hundreds of pumpkins and other gourds of different sizes and shapes. And, if they find one they take a liking to, they can usually be purchased to take home, or might even be included in the price if the venue has an entrance fee. Pumpkin patches often also have other Halloween-themed activities at this time of year, whether it’s displays where you can take memorable snaps of your child amongst the pumpkins, wheelbarrow rides for children across a pumpkin field, pop-up refreshments with Halloween-themed food and drink or pumpkin-decorating workshops, they’re always great fun for children. They really help to make Halloween the special time of year that it is. Once you’ve sourced a suitable pumpkin for your child, it’s time for the really fun part — pumpkin carving and decorating! While the carving part may not be suited to children of a young age (knives are super-dangerous), they can usually help, under supervision, with scooping out the flesh and then, the most fun part of all, decorating. Pumpkins can depict faces, spiders, owls or any spooky imagery you or your little one can imagine. And, even if they may be too young to carve the holes,

Once you’ve sourced a suitable pumpkin for your child, it’s time for the really fun part — pumpkin carving and decorating! While the carving part may not be suited to children of a young age (knives are super-dangerous), they can usually help, under supervision, with scooping out the flesh and then, the most fun part of all, decorating. Pumpkins can depict faces, spiders, owls or any spooky imagery you or your little one can imagine. And, even if they may be too young to carve the holes, they can still decorate using paint or markers, or simply enjoy Mum or Dad getting creative on their behalves.

they can still decorate using paint or markers, or simply enjoy Mum or Dad getting creative on their behalves. TIP: Kids don’t even really need a pumpkin; the smallest of children can decorate oranges or yellow/orange bell peppers! They look really cute and an added bonus is that they avoid the need for any carving.

TIP: Kids don’t even really need a pumpkin; the smallest of children can decorate oranges or yellow/orange bell peppers! They look really cute and an added bonus is that they avoid the need for any carving.

Child Benefit is a financial support scheme, provided by the UK Government, that’s there to assist parents and guardians in covering the costs of raising children. It is an essential part of the social safety net in the United Kingdom and aims to help families with the financial responsibilities that come with bringing up children. Eligible families are free to spend Child Benefit however they like, whether that’s on children’s clothes, food, or something else.

Child Benefit is a financial support scheme, provided by the UK Government, that’s there to assist parents and guardians in covering the costs of raising children. It is an essential part of the social safety net in the United Kingdom and aims to help families with the financial responsibilities that come with bringing up children. Eligible families are free to spend Child Benefit however they like, whether that’s on children’s clothes, food, or something else. You can claim Child Benefit for all of your children who meet the eligibility criteria. It may surprise some to learn that there are no restrictions on the number of children you can claim for (unlike with some other types of Government child support), so each eligible child in your care can be covered under this benefit.

You can claim Child Benefit for all of your children who meet the eligibility criteria. It may surprise some to learn that there are no restrictions on the number of children you can claim for (unlike with some other types of Government child support), so each eligible child in your care can be covered under this benefit. Child Benefit can be affected by your or your partner’s individual income if either of you earns over £50,000 annually. In such cases, you may have to pay a ‘High Income Child Benefit Tax Charge’. This charge gradually reduces your Child Benefit entitlement if your income is between £50,000 and £60,000. Indeed, if your income exceeds £60,000, you’ll likely have to repay the entire amount through this tax charge. We’ll cover more of the detail in the next section below…

Child Benefit can be affected by your or your partner’s individual income if either of you earns over £50,000 annually. In such cases, you may have to pay a ‘High Income Child Benefit Tax Charge’. This charge gradually reduces your Child Benefit entitlement if your income is between £50,000 and £60,000. Indeed, if your income exceeds £60,000, you’ll likely have to repay the entire amount through this tax charge. We’ll cover more of the detail in the next section below… Claiming Child Benefit is a straightforward process:

Claiming Child Benefit is a straightforward process:

Identification of a special educational need or disability is, of course, the first step in being able to properly support a child with SEND. For this reason, good early years providers like Little Cedars Nursery will, as a matter of course, watch out for signs of things that might be challenging for children. As prescribed by

Identification of a special educational need or disability is, of course, the first step in being able to properly support a child with SEND. For this reason, good early years providers like Little Cedars Nursery will, as a matter of course, watch out for signs of things that might be challenging for children. As prescribed by  Support plans for suspected or confirmed special needs or disabilities are then discussed and custom-designed for the child. Such plans will be agreed between the child’s parents/caregivers, staff at the early years setting itself and any external specialists or professionals involved in the child’s care. Such programmes will be customised to suit the individual child’s specific needs and may include tailored activities, strategies, resources and so on. Formalisation of the support programme will allow all parties to pull in the same direction, working cooperatively for the benefit of the child.

Support plans for suspected or confirmed special needs or disabilities are then discussed and custom-designed for the child. Such plans will be agreed between the child’s parents/caregivers, staff at the early years setting itself and any external specialists or professionals involved in the child’s care. Such programmes will be customised to suit the individual child’s specific needs and may include tailored activities, strategies, resources and so on. Formalisation of the support programme will allow all parties to pull in the same direction, working cooperatively for the benefit of the child. In parallel to the SENCo at the child’s early years setting, local authorities also have their own Special Educational Needs Coordinator, known as the Area SENCo. They will also be integral to a child’s SEND support plan, helping with coordination between the local authority, the various parties involved in supporting the child, and in relation to any special funding requirements. If approved, special funding might be required, for example, for an additional member of staff tasked with giving one-to-one support to the child, or to fund extra learning resources and activities for them.

In parallel to the SENCo at the child’s early years setting, local authorities also have their own Special Educational Needs Coordinator, known as the Area SENCo. They will also be integral to a child’s SEND support plan, helping with coordination between the local authority, the various parties involved in supporting the child, and in relation to any special funding requirements. If approved, special funding might be required, for example, for an additional member of staff tasked with giving one-to-one support to the child, or to fund extra learning resources and activities for them. All 3- and 4-year-olds living in England are eligible for a minimum of 570 hours of free childcare per annum, irrespective of whether or not they have SEND. This is known as Universal Free Childcare or their Free entitlement and is typically taken as 15 hours of childcare each week over 38 weeks of the year, but how it is taken can differ.

All 3- and 4-year-olds living in England are eligible for a minimum of 570 hours of free childcare per annum, irrespective of whether or not they have SEND. This is known as Universal Free Childcare or their Free entitlement and is typically taken as 15 hours of childcare each week over 38 weeks of the year, but how it is taken can differ.

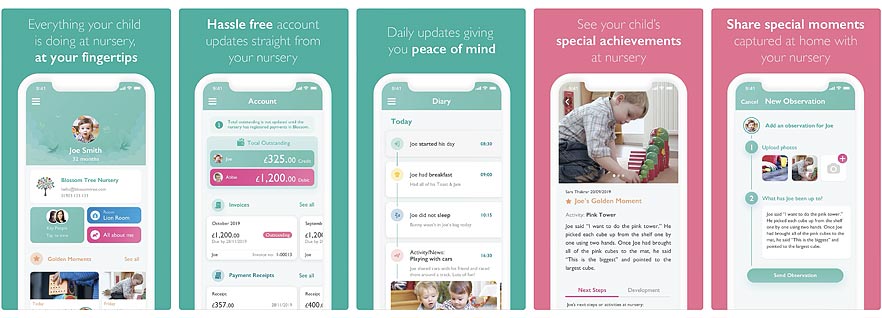

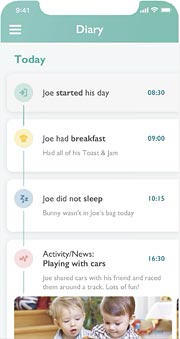

With the Blossom app, you can get real-time updates on your child’s activities at nursery/pre-school, including nappy changes, meals, naps, and developmental moments. You can also view photos and videos of your child’s day, helping you feel connected to your child even when you’re not there.

With the Blossom app, you can get real-time updates on your child’s activities at nursery/pre-school, including nappy changes, meals, naps, and developmental moments. You can also view photos and videos of your child’s day, helping you feel connected to your child even when you’re not there. The Blossom app also provides a useful mechanism for booking non-standard childcare sessions that fall outside of your child’s usual days and hours. With the app, you simply request a particular session and the childcare provider will see your request and let you know whether it’s approved.

The Blossom app also provides a useful mechanism for booking non-standard childcare sessions that fall outside of your child’s usual days and hours. With the app, you simply request a particular session and the childcare provider will see your request and let you know whether it’s approved. Convenient Payment & Invoicing

Convenient Payment & Invoicing