The arrival of July brings with it an annual request for young citizen scientists to help in the world’s largest butterfly survey. Adults, teens, younger children and even little ones under five can all play their part. Butterflies are beautiful creatures for children to see and taking part in the survey takes as little as just 15 minutes. This important nature-based activity is also fun, free, and educational, and will help in the conservation of butterflies and the UK’s natural world. With all that in mind, today’s guide tells you everything you need to know about taking part in the Big Butterfly Count for 2024.

What Is the Big Butterfly Count?

Since 2010, the Big Butterfly Count has taken place during the ‘peak butterfly’ period each year in the UK. During the count, thousands of people across the nation spend as little as 15 minutes surveying how many butterflies and day-flying moths they can spot, and of which species. Their findings are then submitted to the Butterfly Conservation scheme so that a detailed picture can be pieced together about butterfly populations across Britain.

“Counting butterflies can be described as taking the pulse of nature and we depend on you, our citizen scientists, to help us assess how much help nature needs.” (Butterfly Conservation)

Why Butterflies?

Butterflies are important to the UK’s ecosystem because they pollinate food crops and themselves form part of nature’s food chain. However, populations of butterflies have declined significantly in recent decades.

“80% of butterflies have declined since the 1970s and we have lost up to 44% of moths in the UK. ” (Butterfly Conservation)

This may be due to factors like habitat loss, climate change, and the use of harmful and indiscriminate pesticides. The decline is alarming from the perspective of butterfly conservation – some species are in real danger of extinction – as well as being a warning barometer for the state of nature overall. By monitoring butterfly and daytime-flying moth populations, experts can get a better idea of the health of biodiversity and the natural environment across Britain and, by doing so each year, identify trends over time. Only through such a widespread and comprehensive approach can measures be put in place to try to fix any problems identified. The Big Butterfly Count is therefore an important and hugely worthwhile activity for children and families to get involved in during July and early August.

When is 2024’s Big Butterfly Count Taking Place?

The Big Butterfly Count itself starts on Friday 12th July 2024 and will run to Sunday 4th August. However, the overall scheme and Big Butterfly Count smartphone app open on the 1st of July so that people can prepare, plan where to spot the butterflies, and so on.

How Can Children & Families Get Involved?

It’s simple for children, families and individuals to take part. It can take as little as just 15 minutes and is totally free.

What to Do

- Preparation is the first step. This is made easy for families because all the necessary resources are supplied by Butterfly Conservation, the initiative’s organisers. Download a free butterfly identification chart for your area here. This can be printed out for your child. Alternatively, for those with smartphones, simply download the Big Butterfly Count app (available free on IOS and Android) which incorporates everything you need, all in one place, including additional tools that are both helpful and highly informative.

- When you/your children are ready for the count, find a suitable butterfly-spotting location* and count the targeted butterflies and daytime-flying moths that you can see over the course of 15 minutes. This must occur during the period from Friday the 12th of July to Sunday the 4th of August 2024 inclusive. The smartphone app and/or identification chart from Step 1 above will help you identify the species of each butterfly you spot. More details about counting butterflies can be found here.

- Submit your findings via the scheme’s website or directly through the smartphone app (please note that, in each case, you will not be able to submit your results until the count is officially open). You can submit your butterfly sightings right up until the end of August and may submit more than one entry.

* Butterflies are more likely to be around when it’s sunny and sheltered, and there are lots of flowers and blossoms in bloom. Another option is to simply attract butterflies to your own garden; explained for children and families here.

How to See Results of the Count

Once the event is over (from 5th August inclusive), you can visit the event’s official map, which is interactive. Zoom in on your area to see which butterflies you and others spotted. You’ll be able to filter by species and date and see total butterfly counts and even the number of citizen scientists who have taken part.

Little Cedars Nursery, Streatham

At Little Cedars Nursery in Streatham, our childcare practitioners fully understand the enormous benefits of nature to children. It’s simply transformational, which is why we have outdoor spaces where children are able to sow seeds, tend to plants, and even grow vegetables. Nature teaches them so much and we therefore wholeheartedly recommend children’s involvement in the Big Butterfly Count each year.

At Little Cedars Nursery in Streatham, our childcare practitioners fully understand the enormous benefits of nature to children. It’s simply transformational, which is why we have outdoor spaces where children are able to sow seeds, tend to plants, and even grow vegetables. Nature teaches them so much and we therefore wholeheartedly recommend children’s involvement in the Big Butterfly Count each year.

First-class Childcare for Families in Streatham, Tooting, Furzedown, & Balham

Little Cedars is a high-quality nursery and preschool in Streatham, also close to Furzedown, Tooting, Balham, Norbury and Colliers Wood. If you’d like to consider sending your child under five to this wonderful nursery, please get in touch today. The setting has the backing of Government-funded childcare schemes for eligible families and a ‘Good Provider’ rating by Ofsted. Please choose an option to get started:

National Children’s Gardening Week takes place each year in the UK during what’s known as the ‘warm week’ beginning right at the end of May. This year (2024) it spans from 25 May to 2 June. However, children can get involved in gardening well outside of those dates*, of course.

National Children’s Gardening Week takes place each year in the UK during what’s known as the ‘warm week’ beginning right at the end of May. This year (2024) it spans from 25 May to 2 June. However, children can get involved in gardening well outside of those dates*, of course. This year (2024), National Children’s Gardening Week has teamed up with The World of Peter Rabbit and is encouraging children and their families to Grow With Peter Rabbit!

This year (2024), National Children’s Gardening Week has teamed up with The World of Peter Rabbit and is encouraging children and their families to Grow With Peter Rabbit!

Did you know, there are some incredibly

Did you know, there are some incredibly

Compost heaps are also wonderful homes for minibeasts, which are also fun and educational for children to spot. Use our previously published

Compost heaps are also wonderful homes for minibeasts, which are also fun and educational for children to spot. Use our previously published  So, making a wildlife-friendly garden or area is a very worthwhile activity for children to take part in — and is educational on so many levels. See

So, making a wildlife-friendly garden or area is a very worthwhile activity for children to take part in — and is educational on so many levels. See  Children can do ‘gardening’ activities indoors too! Get them to

Children can do ‘gardening’ activities indoors too! Get them to  The benefits of gardening for children are many and varied and that’s why it’s such a wonderful activity to get them involved in. It will teach children many new skills and new knowledge. It’ll teach them about the circle of life, how to care and be responsible for other living things, and about the importance of looking after the planet. It will also give them an insight into where some food types come from. It is also great fun, will give children a huge sense of achievement, and may even open their eyes to the possibility of careers in horticulture, land management, food production, farming, and the like. And, of course, gardening makes the world a better place in so many ways. Let’s also not forget that

The benefits of gardening for children are many and varied and that’s why it’s such a wonderful activity to get them involved in. It will teach children many new skills and new knowledge. It’ll teach them about the circle of life, how to care and be responsible for other living things, and about the importance of looking after the planet. It will also give them an insight into where some food types come from. It is also great fun, will give children a huge sense of achievement, and may even open their eyes to the possibility of careers in horticulture, land management, food production, farming, and the like. And, of course, gardening makes the world a better place in so many ways. Let’s also not forget that

Getting children interested in nature, and spending time around it, is extremely good for them as we’ve reported before —

Getting children interested in nature, and spending time around it, is extremely good for them as we’ve reported before —

Parents and children, don’t miss this year’s incredibly important birdwatching activity for the RSPB — and the planet — which occurs from Friday 26th to Sunday 28th January. The Big Garden Birdwatch only takes one hour, is free, and is an extremely worthwhile activity for children and families to take part in. It’s a great way to introduce children to the concept of conservation as well as getting them interested in spending time in and around nature. And, as we’ve reported before, nature is extremely good for children! In today’s post, we explain how easy it is to get your little ones involved and why taking part is a win-win-win for families, birds and nature.

Parents and children, don’t miss this year’s incredibly important birdwatching activity for the RSPB — and the planet — which occurs from Friday 26th to Sunday 28th January. The Big Garden Birdwatch only takes one hour, is free, and is an extremely worthwhile activity for children and families to take part in. It’s a great way to introduce children to the concept of conservation as well as getting them interested in spending time in and around nature. And, as we’ve reported before, nature is extremely good for children! In today’s post, we explain how easy it is to get your little ones involved and why taking part is a win-win-win for families, birds and nature. Monitoring populations of bird species every year allows the RSPB and other conservation organisations to see how the various types of garden birds are faring. Whether or not they’re doing well will be a barometer of the state of nature itself as well as that of the individual bird populations. If the RSPB and other conservation organisations can see a problem, they can then mobilise to try to do something about it. Likewise, if they see a particular bird species doing well, they can learn from that and better understand what measures are helping that particular bird population to thrive.

Monitoring populations of bird species every year allows the RSPB and other conservation organisations to see how the various types of garden birds are faring. Whether or not they’re doing well will be a barometer of the state of nature itself as well as that of the individual bird populations. If the RSPB and other conservation organisations can see a problem, they can then mobilise to try to do something about it. Likewise, if they see a particular bird species doing well, they can learn from that and better understand what measures are helping that particular bird population to thrive. In 2023, the bird species spotted the most was the House Sparrow, followed by the Blue Tit in second place, Starling in third, Wood Pigeon in fourth and Blackbird in fifth.

In 2023, the bird species spotted the most was the House Sparrow, followed by the Blue Tit in second place, Starling in third, Wood Pigeon in fourth and Blackbird in fifth. By registering you’ll also get a free guide to taking part in the event, which includes visual reference to the birds to look out for, as well as other perks like a discount on bird food and other bird feeding supplies available from the RSPB’s online shop.

By registering you’ll also get a free guide to taking part in the event, which includes visual reference to the birds to look out for, as well as other perks like a discount on bird food and other bird feeding supplies available from the RSPB’s online shop. If you’re keen to attract as many birds as possible to your Garden Birdwatch count, the RSPB has you covered. As well as providing useful

If you’re keen to attract as many birds as possible to your Garden Birdwatch count, the RSPB has you covered. As well as providing useful

Child Benefit is a financial support scheme, provided by the UK Government, that’s there to assist parents and guardians in covering the costs of raising children. It is an essential part of the social safety net in the United Kingdom and aims to help families with the financial responsibilities that come with bringing up children. Eligible families are free to spend Child Benefit however they like, whether that’s on children’s clothes, food, or something else.

Child Benefit is a financial support scheme, provided by the UK Government, that’s there to assist parents and guardians in covering the costs of raising children. It is an essential part of the social safety net in the United Kingdom and aims to help families with the financial responsibilities that come with bringing up children. Eligible families are free to spend Child Benefit however they like, whether that’s on children’s clothes, food, or something else. You can claim Child Benefit for all of your children who meet the eligibility criteria. It may surprise some to learn that there are no restrictions on the number of children you can claim for (unlike with some other types of Government child support), so each eligible child in your care can be covered under this benefit.

You can claim Child Benefit for all of your children who meet the eligibility criteria. It may surprise some to learn that there are no restrictions on the number of children you can claim for (unlike with some other types of Government child support), so each eligible child in your care can be covered under this benefit. Child Benefit can be affected by your or your partner’s individual income if either of you earns over £50,000 annually. In such cases, you may have to pay a ‘High Income Child Benefit Tax Charge’. This charge gradually reduces your Child Benefit entitlement if your income is between £50,000 and £60,000. Indeed, if your income exceeds £60,000, you’ll likely have to repay the entire amount through this tax charge. We’ll cover more of the detail in the next section below…

Child Benefit can be affected by your or your partner’s individual income if either of you earns over £50,000 annually. In such cases, you may have to pay a ‘High Income Child Benefit Tax Charge’. This charge gradually reduces your Child Benefit entitlement if your income is between £50,000 and £60,000. Indeed, if your income exceeds £60,000, you’ll likely have to repay the entire amount through this tax charge. We’ll cover more of the detail in the next section below… Claiming Child Benefit is a straightforward process:

Claiming Child Benefit is a straightforward process:

Identification of a special educational need or disability is, of course, the first step in being able to properly support a child with SEND. For this reason, good early years providers like Little Cedars Nursery will, as a matter of course, watch out for signs of things that might be challenging for children. As prescribed by

Identification of a special educational need or disability is, of course, the first step in being able to properly support a child with SEND. For this reason, good early years providers like Little Cedars Nursery will, as a matter of course, watch out for signs of things that might be challenging for children. As prescribed by  Support plans for suspected or confirmed special needs or disabilities are then discussed and custom-designed for the child. Such plans will be agreed between the child’s parents/caregivers, staff at the early years setting itself and any external specialists or professionals involved in the child’s care. Such programmes will be customised to suit the individual child’s specific needs and may include tailored activities, strategies, resources and so on. Formalisation of the support programme will allow all parties to pull in the same direction, working cooperatively for the benefit of the child.

Support plans for suspected or confirmed special needs or disabilities are then discussed and custom-designed for the child. Such plans will be agreed between the child’s parents/caregivers, staff at the early years setting itself and any external specialists or professionals involved in the child’s care. Such programmes will be customised to suit the individual child’s specific needs and may include tailored activities, strategies, resources and so on. Formalisation of the support programme will allow all parties to pull in the same direction, working cooperatively for the benefit of the child. In parallel to the SENCo at the child’s early years setting, local authorities also have their own Special Educational Needs Coordinator, known as the Area SENCo. They will also be integral to a child’s SEND support plan, helping with coordination between the local authority, the various parties involved in supporting the child, and in relation to any special funding requirements. If approved, special funding might be required, for example, for an additional member of staff tasked with giving one-to-one support to the child, or to fund extra learning resources and activities for them.

In parallel to the SENCo at the child’s early years setting, local authorities also have their own Special Educational Needs Coordinator, known as the Area SENCo. They will also be integral to a child’s SEND support plan, helping with coordination between the local authority, the various parties involved in supporting the child, and in relation to any special funding requirements. If approved, special funding might be required, for example, for an additional member of staff tasked with giving one-to-one support to the child, or to fund extra learning resources and activities for them. All 3- and 4-year-olds living in England are eligible for a minimum of 570 hours of free childcare per annum, irrespective of whether or not they have SEND. This is known as Universal Free Childcare or their Free entitlement and is typically taken as 15 hours of childcare each week over 38 weeks of the year, but how it is taken can differ.

All 3- and 4-year-olds living in England are eligible for a minimum of 570 hours of free childcare per annum, irrespective of whether or not they have SEND. This is known as Universal Free Childcare or their Free entitlement and is typically taken as 15 hours of childcare each week over 38 weeks of the year, but how it is taken can differ.

Following on from our

Following on from our

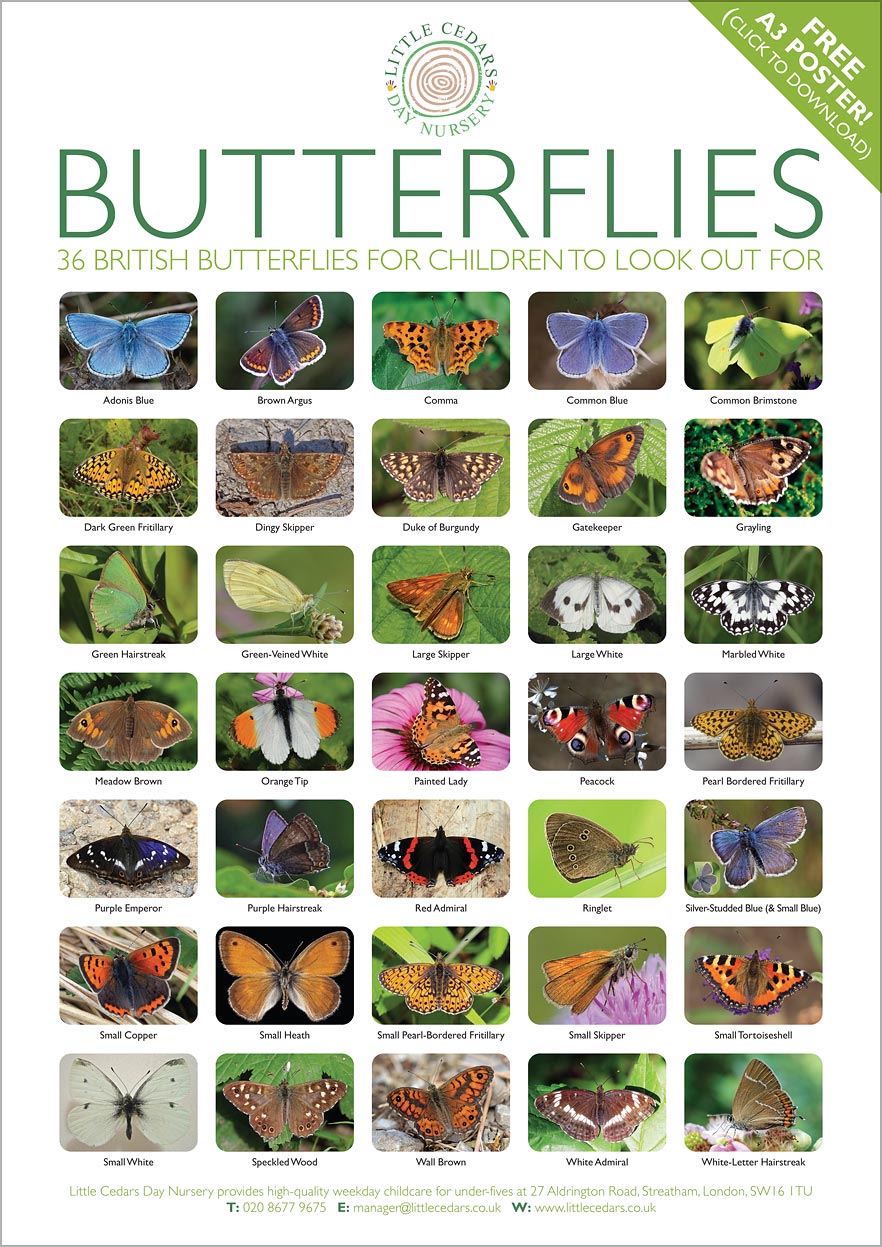

We must also add that children should be encouraged to ‘look but don’t touch’ as butterflies are very delicate creatures. Children should not try to touch or catch them — they are best left in peace as every one of them is a little individual that simply wants to go about his or her day. They’re wonderful to watch, though, and our free poster should help children and adults identify many of the different types. Perhaps see how many different species can be spotted over the course of a year. Take photos too, and compare them with friends! Some butterflies visit gardens, floral window boxes and parks while others may only be found in wilder locations in the countryside. This activity is therefore a great excuse for families to get out and explore The Great Outdoors! Recording the date and location of each butterfly spotted will also help families work out where the best butterfly-spotting locations are for next time.

We must also add that children should be encouraged to ‘look but don’t touch’ as butterflies are very delicate creatures. Children should not try to touch or catch them — they are best left in peace as every one of them is a little individual that simply wants to go about his or her day. They’re wonderful to watch, though, and our free poster should help children and adults identify many of the different types. Perhaps see how many different species can be spotted over the course of a year. Take photos too, and compare them with friends! Some butterflies visit gardens, floral window boxes and parks while others may only be found in wilder locations in the countryside. This activity is therefore a great excuse for families to get out and explore The Great Outdoors! Recording the date and location of each butterfly spotted will also help families work out where the best butterfly-spotting locations are for next time. With that in mind, why not take this activity a step further and get involved in the UK’s annual Big Butterfly Count? For 2024, it takes place between Friday the 12th of July and Sunday the 4th of August, which is when most butterflies are at their adult stage. All it takes is 15 minutes and children will love being little ‘citizen scientists’! The activity can be done in gardens, parks, school grounds or out in the countryside. Taking part will give children a real opportunity to help with butterfly conservation.

With that in mind, why not take this activity a step further and get involved in the UK’s annual Big Butterfly Count? For 2024, it takes place between Friday the 12th of July and Sunday the 4th of August, which is when most butterflies are at their adult stage. All it takes is 15 minutes and children will love being little ‘citizen scientists’! The activity can be done in gardens, parks, school grounds or out in the countryside. Taking part will give children a real opportunity to help with butterfly conservation.