Today’s guide aims to explain everything you ever wanted to know about Child Benefit in the UK. This benefit could be a lifesaver with the current economy and interest rates being what they are. Learn the rules around eligibility, discover how much you can get, and see how many children you can claim for. We’ll also explain what impact your earnings may have, how long you can continue claiming for, and much more. So, if you’re responsible for bringing up a child, take a look!

What Is Child Benefit?

Child Benefit is a financial support scheme, provided by the UK Government, that’s there to assist parents and guardians in covering the costs of raising children. It is an essential part of the social safety net in the United Kingdom and aims to help families with the financial responsibilities that come with bringing up children. Eligible families are free to spend Child Benefit however they like, whether that’s on children’s clothes, food, or something else.

Child Benefit is a financial support scheme, provided by the UK Government, that’s there to assist parents and guardians in covering the costs of raising children. It is an essential part of the social safety net in the United Kingdom and aims to help families with the financial responsibilities that come with bringing up children. Eligible families are free to spend Child Benefit however they like, whether that’s on children’s clothes, food, or something else.

Who is Eligible to Claim Child Benefit?

In the UK, Child Benefit is available to those primarily responsible for raising a child under the age of 16, or under 20 if they’re in approved education or training (N.B. that’s unless they get paid for working 24 or more hours per week instead, begin an apprenticeship, or claim certain benefits themselves).

Child Benefit is usually paid to the person who is primarily “responsible for the child’s care”.

To be eligible, you must be living in the UK, the child you’re claiming for must reside with you, and you must be spending at least the equivalent of the benefit you’ll receive on caring for your child (e.g. through food, clothes, etc.). Up to a certain level, income doesn’t affect eligibility (we’ll explain rules around income later in this guide*) and you do not need to be working. Note also that savings do not affect eligibility. Interestingly, you do not necessarily have to be the child’s parent in order to claim, although only one person can claim for a particular child.

More details about eligibility for Child Benefit can be found here, including some caveats, exceptions and special circumstances.

How Many Children Can You Claim For?

You can claim Child Benefit for all of your children who meet the eligibility criteria. It may surprise some to learn that there are no restrictions on the number of children you can claim for (unlike with some other types of Government child support), so each eligible child in your care can be covered under this benefit.

You can claim Child Benefit for all of your children who meet the eligibility criteria. It may surprise some to learn that there are no restrictions on the number of children you can claim for (unlike with some other types of Government child support), so each eligible child in your care can be covered under this benefit.

How Much Do You Get?

For the 2023/24 tax year, the rates for Child Benefit have increased to the following levels:

• For the eldest or only child: £24.00 per week;

• For additional children: £15.90 per week for each additional child.

Example:

If you are responsible for looking after 3 eligible children, you will get 1 x £24 per week plus 2 x £15.90 each week. That amounts to £55.80 per week or £2901.60 per annum.

These rates can be a valuable contribution to your family’s finances and provide some relief from the costs associated with raising children. They are usually paid to you monthly, however, you may be able to arrange weekly payments in some circumstances. The money is paid directly to you and can be paid into most types of bank or building society accounts, with the exception of Post Office card accounts and Nationwide Cash Builder accounts with sort code 07 00 30 that are registered in someone else’s name.

* How Do Your Earnings Affect It?

Child Benefit can be affected by your or your partner’s individual income if either of you earns over £50,000 annually. In such cases, you may have to pay a ‘High Income Child Benefit Tax Charge’. This charge gradually reduces your Child Benefit entitlement if your income is between £50,000 and £60,000. Indeed, if your income exceeds £60,000, you’ll likely have to repay the entire amount through this tax charge. We’ll cover more of the detail in the next section below…

Child Benefit can be affected by your or your partner’s individual income if either of you earns over £50,000 annually. In such cases, you may have to pay a ‘High Income Child Benefit Tax Charge’. This charge gradually reduces your Child Benefit entitlement if your income is between £50,000 and £60,000. Indeed, if your income exceeds £60,000, you’ll likely have to repay the entire amount through this tax charge. We’ll cover more of the detail in the next section below…

Is Child Benefit Subject to Income Tax?

Whether Child Benefit is subject to Income Tax depends on the level of you/your partner’s income:

- If you or your partner earn less than £50,000 per year, Child Benefit is not subject to Income Tax, i.e. it is tax-free.

- If you or your partner earn over £50,000 and no more than £60,000 per annum, you will need to repay 1% of your Child Benefit income for every £100 earned over the £50,000 threshold. This is done through a special kind of income tax called the ‘High Income Child Benefit Charge’.

- Because that equates to 10% for every £1000 of Childcare Benefit received, 100% of Childcare Benefit has to be repaid through the special income tax charge if you or your partner’s income reaches the upper (£60,000) threshold.

Is Child Benefit Affected by Universal Credit?

No, child benefit is not affected by anything you receive through Universal Credit. As separate schemes in their own right, each is paid independently of the other.

Can Child Benefit Contribute Towards Your State Pension?

Child Benefit will count towards your state pension National Insurance (NI) contributions if the child you are claiming for is under 12 and you are either not in work or do not have sufficient earnings for NI contributions. However, should you not need the NI State Pension credits yourself, you may be able to ask for them to be transferred to your partner/spouse in some circumstances.

How Do You Claim Child Benefit?

Claiming Child Benefit is a straightforward process:

Claiming Child Benefit is a straightforward process:

- You can apply online through the official Government website. Fill out the necessary details and submit the form, and you should start receiving your payments within a few weeks. Learn more about how to claim online and what information you’ll need by watching this video.

- Alternatively, you can use a physical claim form. Two versions of the form exist: a CH2 form to use if you are claiming for up to two children and a CH2 (CS) form for any children in addition to those. Use the bold links to download and print out the forms if you decide to go with the ‘paper’ option.

Tip!

Payments can only be backdated by 3 months. It’s therefore wise to make any claim before your child reaches the age of 3 months.

How Long Can You Claim For?

You can usually claim this benefit until your child reaches the age of 16. However, if your child continues in approved education or training, you can still receive this benefit until they turn 20. As we said before, that’s unless they are paid for working 24 hours or more per week instead of their education or training.

Child Benefit is a crucial source of financial support, helping to ease the financial burden of raising children for eligible families. Be mindful of the income thresholds that may affect your entitlement, and ensure you claim it promptly to access the full value of this funding. Also, keep in mind that Government policies and rates may change over time, so it’s advisable to check the official Government website links above for the most up-to-date information on Child Benefit.

A Nursery Place for Your Child at Little Cedars Nursery, Streatham

Little Cedars is a Nursery & Preschool in Streatham, London SW16

At Little Cedars Nursery in Streatham, SW16, we are mindful of the significant costs associated with bringing up a child. We therefore support all Government-funded childcare schemes for eligible families. Parents/guardians can also rest assured that we’ll give babies, toddlers and preschoolers the very best start in life, in a warm, nurturing environment. And, as Ofsted agree, we are a good nursery and early years provider.

If you’d like to register your child for a nursery place, ask us a question or arrange a tour of the nursery/preschool with your little one, please get in touch — we’ll be delighted to help.

Our childcare service is based in Streatham near Tooting Common and the A214. As such, it is also conveniently located for families in Streatham Hill, Streatham Common, Streatham Park, Furzedown, Tooting, Balham, Norbury, Colliers Wood, West Norwood, Wandsworth, Clapham and Brixton.

Identification of a special educational need or disability is, of course, the first step in being able to properly support a child with SEND. For this reason, good early years providers like Little Cedars Nursery will, as a matter of course, watch out for signs of things that might be challenging for children. As prescribed by

Identification of a special educational need or disability is, of course, the first step in being able to properly support a child with SEND. For this reason, good early years providers like Little Cedars Nursery will, as a matter of course, watch out for signs of things that might be challenging for children. As prescribed by  Support plans for suspected or confirmed special needs or disabilities are then discussed and custom-designed for the child. Such plans will be agreed between the child’s parents/caregivers, staff at the early years setting itself and any external specialists or professionals involved in the child’s care. Such programmes will be customised to suit the individual child’s specific needs and may include tailored activities, strategies, resources and so on. Formalisation of the support programme will allow all parties to pull in the same direction, working cooperatively for the benefit of the child.

Support plans for suspected or confirmed special needs or disabilities are then discussed and custom-designed for the child. Such plans will be agreed between the child’s parents/caregivers, staff at the early years setting itself and any external specialists or professionals involved in the child’s care. Such programmes will be customised to suit the individual child’s specific needs and may include tailored activities, strategies, resources and so on. Formalisation of the support programme will allow all parties to pull in the same direction, working cooperatively for the benefit of the child. In parallel to the SENCo at the child’s early years setting, local authorities also have their own Special Educational Needs Coordinator, known as the Area SENCo. They will also be integral to a child’s SEND support plan, helping with coordination between the local authority, the various parties involved in supporting the child, and in relation to any special funding requirements. If approved, special funding might be required, for example, for an additional member of staff tasked with giving one-to-one support to the child, or to fund extra learning resources and activities for them.

In parallel to the SENCo at the child’s early years setting, local authorities also have their own Special Educational Needs Coordinator, known as the Area SENCo. They will also be integral to a child’s SEND support plan, helping with coordination between the local authority, the various parties involved in supporting the child, and in relation to any special funding requirements. If approved, special funding might be required, for example, for an additional member of staff tasked with giving one-to-one support to the child, or to fund extra learning resources and activities for them. All 3- and 4-year-olds living in England are eligible for a minimum of 570 hours of free childcare per annum, irrespective of whether or not they have SEND. This is known as Universal Free Childcare or their Free entitlement and is typically taken as 15 hours of childcare each week over 38 weeks of the year, but how it is taken can differ.

All 3- and 4-year-olds living in England are eligible for a minimum of 570 hours of free childcare per annum, irrespective of whether or not they have SEND. This is known as Universal Free Childcare or their Free entitlement and is typically taken as 15 hours of childcare each week over 38 weeks of the year, but how it is taken can differ.

Following on from our

Following on from our

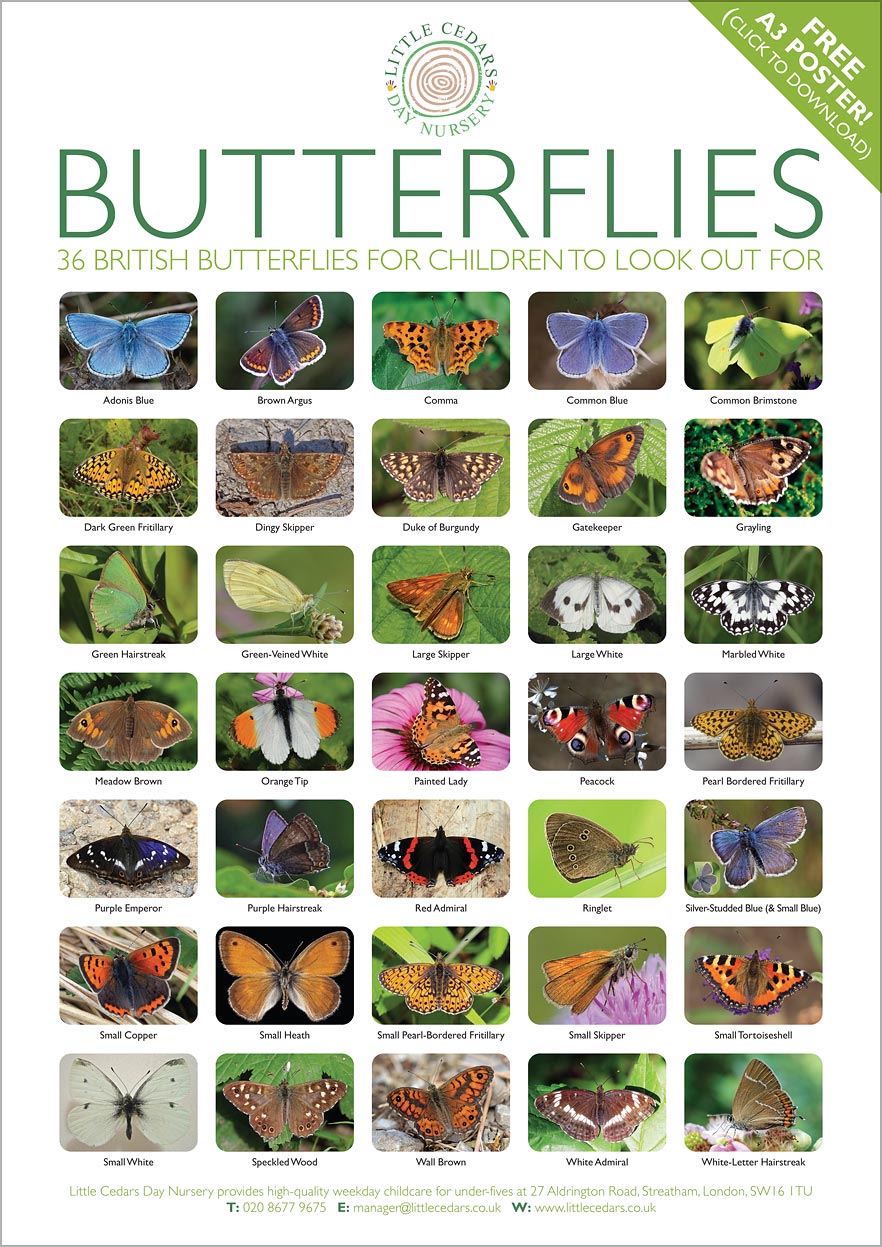

We must also add that children should be encouraged to ‘look but don’t touch’ as butterflies are very delicate creatures. Children should not try to touch or catch them — they are best left in peace as every one of them is a little individual that simply wants to go about his or her day. They’re wonderful to watch, though, and our free poster should help children and adults identify many of the different types. Perhaps see how many different species can be spotted over the course of a year. Take photos too, and compare them with friends! Some butterflies visit gardens, floral window boxes and parks while others may only be found in wilder locations in the countryside. This activity is therefore a great excuse for families to get out and explore The Great Outdoors! Recording the date and location of each butterfly spotted will also help families work out where the best butterfly-spotting locations are for next time.

We must also add that children should be encouraged to ‘look but don’t touch’ as butterflies are very delicate creatures. Children should not try to touch or catch them — they are best left in peace as every one of them is a little individual that simply wants to go about his or her day. They’re wonderful to watch, though, and our free poster should help children and adults identify many of the different types. Perhaps see how many different species can be spotted over the course of a year. Take photos too, and compare them with friends! Some butterflies visit gardens, floral window boxes and parks while others may only be found in wilder locations in the countryside. This activity is therefore a great excuse for families to get out and explore The Great Outdoors! Recording the date and location of each butterfly spotted will also help families work out where the best butterfly-spotting locations are for next time. With that in mind, why not take this activity a step further and get involved in the UK’s annual Big Butterfly Count? For 2024, it takes place between Friday the 12th of July and Sunday the 4th of August, which is when most butterflies are at their adult stage. All it takes is 15 minutes and children will love being little ‘citizen scientists’! The activity can be done in gardens, parks, school grounds or out in the countryside. Taking part will give children a real opportunity to help with butterfly conservation.

With that in mind, why not take this activity a step further and get involved in the UK’s annual Big Butterfly Count? For 2024, it takes place between Friday the 12th of July and Sunday the 4th of August, which is when most butterflies are at their adult stage. All it takes is 15 minutes and children will love being little ‘citizen scientists’! The activity can be done in gardens, parks, school grounds or out in the countryside. Taking part will give children a real opportunity to help with butterfly conservation.

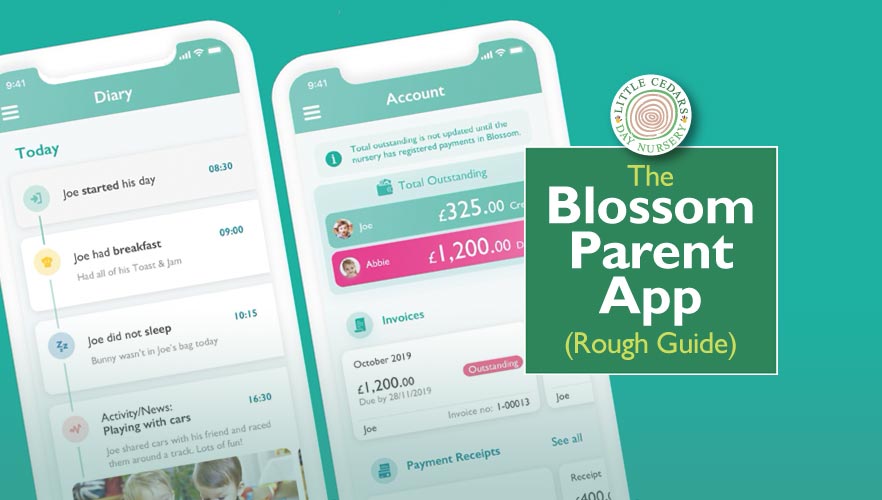

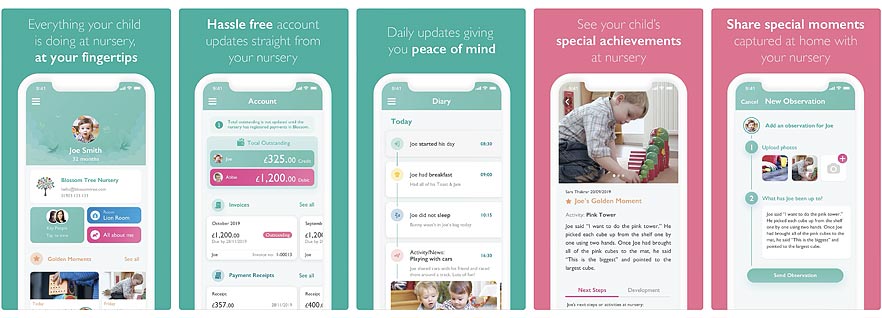

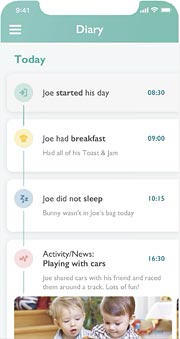

With the Blossom app, you can get real-time updates on your child’s activities at nursery/pre-school, including nappy changes, meals, naps, and developmental moments. You can also view photos and videos of your child’s day, helping you feel connected to your child even when you’re not there.

With the Blossom app, you can get real-time updates on your child’s activities at nursery/pre-school, including nappy changes, meals, naps, and developmental moments. You can also view photos and videos of your child’s day, helping you feel connected to your child even when you’re not there. The Blossom app also provides a useful mechanism for booking non-standard childcare sessions that fall outside of your child’s usual days and hours. With the app, you simply request a particular session and the childcare provider will see your request and let you know whether it’s approved.

The Blossom app also provides a useful mechanism for booking non-standard childcare sessions that fall outside of your child’s usual days and hours. With the app, you simply request a particular session and the childcare provider will see your request and let you know whether it’s approved. Convenient Payment & Invoicing

Convenient Payment & Invoicing

With Universal Free Childcare, children aged 3 or 4 can receive up to 570 hours of free childcare over the course of the year.

With Universal Free Childcare, children aged 3 or 4 can receive up to 570 hours of free childcare over the course of the year. With Extended Free Childcare, eligible 3- and 4-year-olds can receive up to 1140 hours of free childcare per year instead of only 570.

With Extended Free Childcare, eligible 3- and 4-year-olds can receive up to 1140 hours of free childcare per year instead of only 570. Some disadvantaged children aged 2 can also receive up to 570 hours of free childcare over the course of the year.

Some disadvantaged children aged 2 can also receive up to 570 hours of free childcare over the course of the year. For those that are eligible, up to £2,000 in free childcare is available each year to children aged 11 or under* through the Tax-Free Childcare scheme.

For those that are eligible, up to £2,000 in free childcare is available each year to children aged 11 or under* through the Tax-Free Childcare scheme. You can sacrifice up to £55 per week of your earnings, which will be free of National Insurance and Income Tax, to fund Childcare Vouchers.

You can sacrifice up to £55 per week of your earnings, which will be free of National Insurance and Income Tax, to fund Childcare Vouchers. Following the Spring Budget 2023, childcare funding through Universal Credit is to be improved with nearly 50% more generous funding becoming available from July 2023.

Following the Spring Budget 2023, childcare funding through Universal Credit is to be improved with nearly 50% more generous funding becoming available from July 2023. Those already claiming for childcare costs via Working Tax Credits may be able to obtain up to £122.50 for one or £210.00 for more than one child each week.

Those already claiming for childcare costs via Working Tax Credits may be able to obtain up to £122.50 for one or £210.00 for more than one child each week. 2-year-olds may be eligible for the ’15 Hours’ scheme from April 2024.

2-year-olds may be eligible for the ’15 Hours’ scheme from April 2024. Up to 85% of childcare costs incurred by students may be claimed, up to a maximum of £188.90 per week for 1 child or £323.85 for 2 or more (correct for academic year 2023-2024).

Up to 85% of childcare costs incurred by students may be claimed, up to a maximum of £188.90 per week for 1 child or £323.85 for 2 or more (correct for academic year 2023-2024). Up to £160 per child is available each week for those living outside London.

Up to £160 per child is available each week for those living outside London. While it’s not designed to fund childcare, it can be used to do so in some circumstances.

While it’s not designed to fund childcare, it can be used to do so in some circumstances.

March 15th 2023 saw the Chancellor of the Exchequer’s Spring Budget announcement, which included news of extra funding to cover costs for childcare. Crucially, the new funding will support childcare for infants as young as 9 months old for the first time, as well as including other positive changes. Although it’ll be introduced in stages, the free funding should be welcome news for those parents who will be eligible. Let’s take a look today at the proposed childcare changes, including which age groups will benefit, what extra funding is promised to support families and when the new help will become available. First, though, we’ll look at the main aims of the new funding.

March 15th 2023 saw the Chancellor of the Exchequer’s Spring Budget announcement, which included news of extra funding to cover costs for childcare. Crucially, the new funding will support childcare for infants as young as 9 months old for the first time, as well as including other positive changes. Although it’ll be introduced in stages, the free funding should be welcome news for those parents who will be eligible. Let’s take a look today at the proposed childcare changes, including which age groups will benefit, what extra funding is promised to support families and when the new help will become available. First, though, we’ll look at the main aims of the new funding. The ‘main event’ in the Spring Budget from the perspective of childcare provision is the significant expansion of the ‘free hours’ schemes. Previously, only

The ‘main event’ in the Spring Budget from the perspective of childcare provision is the significant expansion of the ‘free hours’ schemes. Previously, only  Some struggling parents in receipt of Universal Credit childcare support, who would like to move into work or increase existing working hours, will have subsidised childcare costs paid in advance under the new proposals. This is in contrast to the existing approach where all parents had to pay for the childcare upfront and then reclaim the costs retrospectively. Funding the childcare costs in advance will make the subsidised childcare costs much easier for the lowest-income families to afford from a practical, cash-flow point of view. It will also hopefully improve the situation whereby, currently, only 13% of eligible low-income families actually claim the childcare element of Universal Credit.

Some struggling parents in receipt of Universal Credit childcare support, who would like to move into work or increase existing working hours, will have subsidised childcare costs paid in advance under the new proposals. This is in contrast to the existing approach where all parents had to pay for the childcare upfront and then reclaim the costs retrospectively. Funding the childcare costs in advance will make the subsidised childcare costs much easier for the lowest-income families to afford from a practical, cash-flow point of view. It will also hopefully improve the situation whereby, currently, only 13% of eligible low-income families actually claim the childcare element of Universal Credit. Although this website and our childcare service are geared to the early years age groups, it would be remiss of us not to include a brief overview of the enhancements that are being introduced for children of school age. These are coming in via proposed changes to what is known as ‘Wraparound Care’ as we’ll explain.

Although this website and our childcare service are geared to the early years age groups, it would be remiss of us not to include a brief overview of the enhancements that are being introduced for children of school age. These are coming in via proposed changes to what is known as ‘Wraparound Care’ as we’ll explain.

Improving Education for Disadvantaged 3- & 4-Year-Olds

Improving Education for Disadvantaged 3- & 4-Year-Olds To be eligible for the EYPP funding, a child must meet certain criteria:

To be eligible for the EYPP funding, a child must meet certain criteria: After checking eligibility, interested families or guardians can either

After checking eligibility, interested families or guardians can either

Today’s post will appeal to families who are finding the current financial climate particularly challenging. With energy costs and inflation so high, the following may represent a welcome piece of good news. Today we highlight the many Baby Banks that are popping up all around the UK and explain how they can help struggling families, all for free.

Today’s post will appeal to families who are finding the current financial climate particularly challenging. With energy costs and inflation so high, the following may represent a welcome piece of good news. Today we highlight the many Baby Banks that are popping up all around the UK and explain how they can help struggling families, all for free. A Baby bank is a similar concept to a food bank. However, instead of food and drink, it provides second-hand clothing, toys and equipment for babies, under-fives and often even for children up to the age of 16 in some cases. Baby Banks can also be compared to a charity shop, however, with baby banks, everything is free.

A Baby bank is a similar concept to a food bank. However, instead of food and drink, it provides second-hand clothing, toys and equipment for babies, under-fives and often even for children up to the age of 16 in some cases. Baby Banks can also be compared to a charity shop, however, with baby banks, everything is free. Baby Banks are run by all sorts of different people and organisations and therefore the rules around actually getting ones hands on the free items vary from Baby Bank to Baby Bank. Some accept requests for items directly from families themselves. Others only deal via a referral from some kind of professional. Examples include social workers, family support agencies, teachers, family centres, health visitors, medical professionals, food banks and women’s refuges. So, once you have located your nearest Baby Bank, you will need to check whether they will deal with you directly or only through such a referral. Either way, you will usually need to agree a time and date for collection of your item with the Baby Bank (you can’t usually just turn up, although there are exceptions). Not all Baby Banks are open all week and that’s another reason to check with Baby Banks or their websites first.

Baby Banks are run by all sorts of different people and organisations and therefore the rules around actually getting ones hands on the free items vary from Baby Bank to Baby Bank. Some accept requests for items directly from families themselves. Others only deal via a referral from some kind of professional. Examples include social workers, family support agencies, teachers, family centres, health visitors, medical professionals, food banks and women’s refuges. So, once you have located your nearest Baby Bank, you will need to check whether they will deal with you directly or only through such a referral. Either way, you will usually need to agree a time and date for collection of your item with the Baby Bank (you can’t usually just turn up, although there are exceptions). Not all Baby Banks are open all week and that’s another reason to check with Baby Banks or their websites first. Absolutely! Baby Banks rely on the generous donations from families that no long require their baby clothes or equipment. Perhaps the child has grown out of them and the items are still in good condition, or perhaps they were an unwanted gift. Donating items is also a great way to declutter and to make space in the home, as well as helping others. However, before donating to a Baby Bank, always check with them to see if all your proposed items are required and, as before, ensure you know whether an appointment is needed or whether you can just turn up with your items. Certain rules may also apply around the condition and type of items (this varies depending upon which Baby Bank you are dealing with). Baby car seats and electronic items may also have special rules due to the extra safety considerations.

Absolutely! Baby Banks rely on the generous donations from families that no long require their baby clothes or equipment. Perhaps the child has grown out of them and the items are still in good condition, or perhaps they were an unwanted gift. Donating items is also a great way to declutter and to make space in the home, as well as helping others. However, before donating to a Baby Bank, always check with them to see if all your proposed items are required and, as before, ensure you know whether an appointment is needed or whether you can just turn up with your items. Certain rules may also apply around the condition and type of items (this varies depending upon which Baby Bank you are dealing with). Baby car seats and electronic items may also have special rules due to the extra safety considerations.

Are you a student as well as a parent? If so, there are several Government schemes that offer help with childcare costs, some of which will save student parents substantial amounts of money. By doing so, they also make the prospect of juggling parenthood with being a student much more manageable. Today we examine the key childcare funding options, including how the type of course and the age of the parent affect eligibility.

Are you a student as well as a parent? If so, there are several Government schemes that offer help with childcare costs, some of which will save student parents substantial amounts of money. By doing so, they also make the prospect of juggling parenthood with being a student much more manageable. Today we examine the key childcare funding options, including how the type of course and the age of the parent affect eligibility. The very generous Student Childcare Grant is available for eligible students who who are studying full-time on a higher education course and have dependent children aged 14 or under (16 or under if they have special needs).

The very generous Student Childcare Grant is available for eligible students who who are studying full-time on a higher education course and have dependent children aged 14 or under (16 or under if they have special needs). If you are aged 20 or over, are a parent studying in further education for a qualification on a Level 3 course or below and are facing financial hardship, you may be eligible for childcare funding under the Learner Support scheme. This funding could help you with childcare and other study-related costs if you fit the right eligibility criteria.

If you are aged 20 or over, are a parent studying in further education for a qualification on a Level 3 course or below and are facing financial hardship, you may be eligible for childcare funding under the Learner Support scheme. This funding could help you with childcare and other study-related costs if you fit the right eligibility criteria. If you are a parent as well as a student aged under 20 when you begin one of a range of publicly-funded courses in England, you may be eligible for childcare funding through the Care to Learn bursary scheme. If eligible, you could claim as much as £175 in childcare per week, per child if you live in London, reducing to £160 per week, per child, outside London.

If you are a parent as well as a student aged under 20 when you begin one of a range of publicly-funded courses in England, you may be eligible for childcare funding through the Care to Learn bursary scheme. If eligible, you could claim as much as £175 in childcare per week, per child if you live in London, reducing to £160 per week, per child, outside London.