When you’re searching for the best nursery for your baby or toddler, or the perfect preschool for your 3-or-4-year-old, the choice can often be overwhelming. A Good Ofsted rating will help, of course. However, genuine customer feedback is crucial as a tool to gauge the suitability of local childcare providers. And recommendations and 5-star ratings can be priceless. So, if you’re a family looking for childcare in the Streatham or Tooting area, it may help to read what the parents of some of our children have to say about us — and that’s exactly what today’s post is designed to showcase.

When you’re searching for the best nursery for your baby or toddler, or the perfect preschool for your 3-or-4-year-old, the choice can often be overwhelming. A Good Ofsted rating will help, of course. However, genuine customer feedback is crucial as a tool to gauge the suitability of local childcare providers. And recommendations and 5-star ratings can be priceless. So, if you’re a family looking for childcare in the Streatham or Tooting area, it may help to read what the parents of some of our children have to say about us — and that’s exactly what today’s post is designed to showcase.

The good news is that our reviews on Google and elsewhere are awash with 5-star reviews and glowing testimonials about the quality of our childcare services and the loving, nurturing qualities found at the setting. Take a look below to read just some of the wonderful feedback that Little Cedars Nursery receives, from families past and present.

Sara Z recommends Little Cedars Day Nursery

![]()

“My daughter has been at Little Cedars for some time now. Lovely little nursery and great staff.”

(Sara Z. via Facebook, June 2022.)

![]()

“Maggie the centre manager was helpful and super efficient with everything! Thank you”

(Charlotte M. via Google, 2 months ago).

![]()

“What an amazing nursery. I had my little ones here for years … they really loved [it] and the management & teachers are so lovely. I just want to say thank you for taking care of my kids so brilliantly. Always so helpful! I will miss you and my kids too xxx”

(Rita T. via Google, 2 months ago).

![]()

“Lovely setting away from the hustle and bustle of Streatham. Nice big garden and friendly staff who always make our baby boy feel welcome. The baby room is clean and full of kind staff – whenever we drop off or collect our child he is in the lap of a team member and given a lot of attention. He loves the rabbits in the garden and gets plenty of outside play. The chef cooks a variety of healthy meals and snacks and is also so friendly with the babies. Prices are affordable for the area without any compromise on quality – we highly recommend LC!”

(Roxanne H. via Google, 2 months ago).

![]()

“My son has been attending this day care for almost 2 years now. As a first time mom I didn’t have enough confidence in myself when it came to choosing a nursery however as soon as I stepped into this facility and met Maggie I knew this was a journey my son and I would enjoy.

Needless to say 2 years in I’m completely happy that I chose Little cedars day care as my son’s educational starting point.

From the little baby room to the toddler room he has grown [in] leaps and bounds, his social skills are amazing, his vocabulary improves with each week and I love the close-knit relationships he enjoys with both the staff and his peers.

The staff are friendly, very attentive and strive for excellence. There are many activities that are planned for the kids throughout the school terms and parents are invited to some which is great and they also have a big outdoor area which is awesome for the little ones to enjoy in all climates.

I love the fact that there are chickens and rabbits in the garden meaning the learning continues beyond the classroom. The toddler room also has a lizard named Lizzy who the kids help look after too, thus again helping develop their nurturing side.

There’s a good ratio of staff to pupils and your child will not be part of the furniture, it’s an overall wonderful experience.

It’s such a lovely atmosphere from drop off to pick up you just know you’ve left your child in an environment where they can learn and explore and be well taken care of all at the same time.

I’d like to extend a big thank you to all the staff at the day care … Thank you from the bottom of my heart!”

(Nomvula B. via Google, 11 months ago).

![]()

“Nice place; my daughter is excited to go there”

(‘Local Guide’ Hamza Y. via Google, a year ago).

![]()

“My daughter attends this nursery for over a year now. I just love the friendly vibes, the lovely facilities (including resources, grand garden and animals!) Maggie, the manager, has been just wonderful and you can see her deep commitment as she often supports her team in the rooms! [A] hands-on manager that will always give you time to talk about your child is a recipe for success! Highly recommended!”

(‘SmallFrog’, via Google, a year ago).

![]()

“Amazing nursery! Our daughter loved it here and all the staff are fantastic!”

(‘Local Guide’ Johann H. via Google).

Your Streatham Nursery & Preschool

A home-from-home that nurtures babies and children under five, in Streatham, near Tooting

It’s clear from the feedback highlighted today that Little Cedars Nursery in Streatham is not just a childcare provider. Indeed, it’s more like an extended family that’s as invested in nurturing the growth and development of little ones as parents are. At Little Cedars, curiosity is sparked, friendships are forged, and the foundation for a love of learning is laid.

It’s clear from the feedback highlighted today that Little Cedars Nursery in Streatham is not just a childcare provider. Indeed, it’s more like an extended family that’s as invested in nurturing the growth and development of little ones as parents are. At Little Cedars, curiosity is sparked, friendships are forged, and the foundation for a love of learning is laid.

If you’re local to Streatham or Tooting and like what you’ve learned in this post today, we look forward to the opportunity to be a part of your child’s early years, shaping moments that matter and creating a haven where your little one can truly thrive.

To enquire about a nursery or preschool place for your child, please get in touch:

Little Cedars is a high-quality childcare nursery in Streatham, close to Streatham Hill, Streatham Park, Streatham Common, Furzedown, Tooting, Tooting Common, Tooting Bec, Tooting Broadway, Balham, Norbury and Colliers Wood.

Why Not Write a Review?

We’d love your feedback! Are you happy with Little Cedars Day Nursery? If so, why not post a review to our Google profile (here)? And, of course, if there’s something you’re not happy with or if you have a suggestion, please let us know and we’ll urgently work to address it. Feedback from parents is incredibly important to us as part of our continuous mission to improve the breadth and quality of the childcare services we provide. Thank you.

Child Benefit is a financial support scheme, provided by the UK Government, that’s there to assist parents and guardians in covering the costs of raising children. It is an essential part of the social safety net in the United Kingdom and aims to help families with the financial responsibilities that come with bringing up children. Eligible families are free to spend Child Benefit however they like, whether that’s on children’s clothes, food, or something else.

Child Benefit is a financial support scheme, provided by the UK Government, that’s there to assist parents and guardians in covering the costs of raising children. It is an essential part of the social safety net in the United Kingdom and aims to help families with the financial responsibilities that come with bringing up children. Eligible families are free to spend Child Benefit however they like, whether that’s on children’s clothes, food, or something else. You can claim Child Benefit for all of your children who meet the eligibility criteria. It may surprise some to learn that there are no restrictions on the number of children you can claim for (unlike with some other types of Government child support), so each eligible child in your care can be covered under this benefit.

You can claim Child Benefit for all of your children who meet the eligibility criteria. It may surprise some to learn that there are no restrictions on the number of children you can claim for (unlike with some other types of Government child support), so each eligible child in your care can be covered under this benefit. Child Benefit can be affected by your or your partner’s individual income if either of you earns over £50,000 annually. In such cases, you may have to pay a ‘High Income Child Benefit Tax Charge’. This charge gradually reduces your Child Benefit entitlement if your income is between £50,000 and £60,000. Indeed, if your income exceeds £60,000, you’ll likely have to repay the entire amount through this tax charge. We’ll cover more of the detail in the next section below…

Child Benefit can be affected by your or your partner’s individual income if either of you earns over £50,000 annually. In such cases, you may have to pay a ‘High Income Child Benefit Tax Charge’. This charge gradually reduces your Child Benefit entitlement if your income is between £50,000 and £60,000. Indeed, if your income exceeds £60,000, you’ll likely have to repay the entire amount through this tax charge. We’ll cover more of the detail in the next section below… Claiming Child Benefit is a straightforward process:

Claiming Child Benefit is a straightforward process:

Identification of a special educational need or disability is, of course, the first step in being able to properly support a child with SEND. For this reason, good early years providers like Little Cedars Nursery will, as a matter of course, watch out for signs of things that might be challenging for children. As prescribed by

Identification of a special educational need or disability is, of course, the first step in being able to properly support a child with SEND. For this reason, good early years providers like Little Cedars Nursery will, as a matter of course, watch out for signs of things that might be challenging for children. As prescribed by  Support plans for suspected or confirmed special needs or disabilities are then discussed and custom-designed for the child. Such plans will be agreed between the child’s parents/caregivers, staff at the early years setting itself and any external specialists or professionals involved in the child’s care. Such programmes will be customised to suit the individual child’s specific needs and may include tailored activities, strategies, resources and so on. Formalisation of the support programme will allow all parties to pull in the same direction, working cooperatively for the benefit of the child.

Support plans for suspected or confirmed special needs or disabilities are then discussed and custom-designed for the child. Such plans will be agreed between the child’s parents/caregivers, staff at the early years setting itself and any external specialists or professionals involved in the child’s care. Such programmes will be customised to suit the individual child’s specific needs and may include tailored activities, strategies, resources and so on. Formalisation of the support programme will allow all parties to pull in the same direction, working cooperatively for the benefit of the child. In parallel to the SENCo at the child’s early years setting, local authorities also have their own Special Educational Needs Coordinator, known as the Area SENCo. They will also be integral to a child’s SEND support plan, helping with coordination between the local authority, the various parties involved in supporting the child, and in relation to any special funding requirements. If approved, special funding might be required, for example, for an additional member of staff tasked with giving one-to-one support to the child, or to fund extra learning resources and activities for them.

In parallel to the SENCo at the child’s early years setting, local authorities also have their own Special Educational Needs Coordinator, known as the Area SENCo. They will also be integral to a child’s SEND support plan, helping with coordination between the local authority, the various parties involved in supporting the child, and in relation to any special funding requirements. If approved, special funding might be required, for example, for an additional member of staff tasked with giving one-to-one support to the child, or to fund extra learning resources and activities for them. All 3- and 4-year-olds living in England are eligible for a minimum of 570 hours of free childcare per annum, irrespective of whether or not they have SEND. This is known as Universal Free Childcare or their Free entitlement and is typically taken as 15 hours of childcare each week over 38 weeks of the year, but how it is taken can differ.

All 3- and 4-year-olds living in England are eligible for a minimum of 570 hours of free childcare per annum, irrespective of whether or not they have SEND. This is known as Universal Free Childcare or their Free entitlement and is typically taken as 15 hours of childcare each week over 38 weeks of the year, but how it is taken can differ.

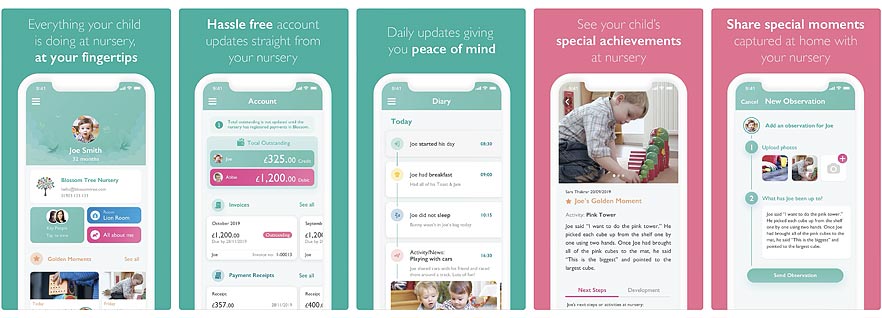

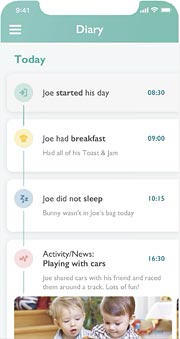

With the Blossom app, you can get real-time updates on your child’s activities at nursery/pre-school, including nappy changes, meals, naps, and developmental moments. You can also view photos and videos of your child’s day, helping you feel connected to your child even when you’re not there.

With the Blossom app, you can get real-time updates on your child’s activities at nursery/pre-school, including nappy changes, meals, naps, and developmental moments. You can also view photos and videos of your child’s day, helping you feel connected to your child even when you’re not there. The Blossom app also provides a useful mechanism for booking non-standard childcare sessions that fall outside of your child’s usual days and hours. With the app, you simply request a particular session and the childcare provider will see your request and let you know whether it’s approved.

The Blossom app also provides a useful mechanism for booking non-standard childcare sessions that fall outside of your child’s usual days and hours. With the app, you simply request a particular session and the childcare provider will see your request and let you know whether it’s approved. Convenient Payment & Invoicing

Convenient Payment & Invoicing

March 15th 2023 saw the Chancellor of the Exchequer’s Spring Budget announcement, which included news of extra funding to cover costs for childcare. Crucially, the new funding will support childcare for infants as young as 9 months old for the first time, as well as including other positive changes. Although it’ll be introduced in stages, the free funding should be welcome news for those parents who will be eligible. Let’s take a look today at the proposed childcare changes, including which age groups will benefit, what extra funding is promised to support families and when the new help will become available. First, though, we’ll look at the main aims of the new funding.

March 15th 2023 saw the Chancellor of the Exchequer’s Spring Budget announcement, which included news of extra funding to cover costs for childcare. Crucially, the new funding will support childcare for infants as young as 9 months old for the first time, as well as including other positive changes. Although it’ll be introduced in stages, the free funding should be welcome news for those parents who will be eligible. Let’s take a look today at the proposed childcare changes, including which age groups will benefit, what extra funding is promised to support families and when the new help will become available. First, though, we’ll look at the main aims of the new funding. The ‘main event’ in the Spring Budget from the perspective of childcare provision is the significant expansion of the ‘free hours’ schemes. Previously, only

The ‘main event’ in the Spring Budget from the perspective of childcare provision is the significant expansion of the ‘free hours’ schemes. Previously, only  Some struggling parents in receipt of Universal Credit childcare support, who would like to move into work or increase existing working hours, will have subsidised childcare costs paid in advance under the new proposals. This is in contrast to the existing approach where all parents had to pay for the childcare upfront and then reclaim the costs retrospectively. Funding the childcare costs in advance will make the subsidised childcare costs much easier for the lowest-income families to afford from a practical, cash-flow point of view. It will also hopefully improve the situation whereby, currently, only 13% of eligible low-income families actually claim the childcare element of Universal Credit.

Some struggling parents in receipt of Universal Credit childcare support, who would like to move into work or increase existing working hours, will have subsidised childcare costs paid in advance under the new proposals. This is in contrast to the existing approach where all parents had to pay for the childcare upfront and then reclaim the costs retrospectively. Funding the childcare costs in advance will make the subsidised childcare costs much easier for the lowest-income families to afford from a practical, cash-flow point of view. It will also hopefully improve the situation whereby, currently, only 13% of eligible low-income families actually claim the childcare element of Universal Credit. Although this website and our childcare service are geared to the early years age groups, it would be remiss of us not to include a brief overview of the enhancements that are being introduced for children of school age. These are coming in via proposed changes to what is known as ‘Wraparound Care’ as we’ll explain.

Although this website and our childcare service are geared to the early years age groups, it would be remiss of us not to include a brief overview of the enhancements that are being introduced for children of school age. These are coming in via proposed changes to what is known as ‘Wraparound Care’ as we’ll explain.

In today’s post, we look at the importance and benefits of periods of ‘quiet time’ for toddlers and children under five. Toddlers are busy little people, often rushing around, going from one toy or activity to the next. They’re at a stage where they realise the world is an exciting place and often want to experience it all at once. However, when they are so ‘on-the-go’, playing and learning from everything and everyone around them, their brains and body have a lot to take in and process. It can be extremely tiring! So, this is where some much-needed quiet time often comes in, bringing with it a whole range of benefits. Studies also back this up.

In today’s post, we look at the importance and benefits of periods of ‘quiet time’ for toddlers and children under five. Toddlers are busy little people, often rushing around, going from one toy or activity to the next. They’re at a stage where they realise the world is an exciting place and often want to experience it all at once. However, when they are so ‘on-the-go’, playing and learning from everything and everyone around them, their brains and body have a lot to take in and process. It can be extremely tiring! So, this is where some much-needed quiet time often comes in, bringing with it a whole range of benefits. Studies also back this up. With so much going on around them, children’s young senses of sight, hearing, touch and smell are experiencing a full-on assault. Their minds are also being challenged with learning new skills. This can all be very tiring for our youngsters, so a period of quiet time will give them a break, to allow them to breathe and unwind.

With so much going on around them, children’s young senses of sight, hearing, touch and smell are experiencing a full-on assault. Their minds are also being challenged with learning new skills. This can all be very tiring for our youngsters, so a period of quiet time will give them a break, to allow them to breathe and unwind. After prolonged activity or concentration on the part of the child, a well-earned nap may well be on the agenda. As well as giving the toddler a chance to re-charge their batteries,

After prolonged activity or concentration on the part of the child, a well-earned nap may well be on the agenda. As well as giving the toddler a chance to re-charge their batteries,  Quiet time provides an opportunity for children to develop their own, natural creativity. During quiet time, they have the opportunity to make up a game or activity, without intervention from others. This time is totally unstructured too, so children can be as free as they like to explore and adapt the game or activity. They can create their own little environment and immerse themselves in their own new world. Their imaginations are set free and opportunities to be creative will come naturally.

Quiet time provides an opportunity for children to develop their own, natural creativity. During quiet time, they have the opportunity to make up a game or activity, without intervention from others. This time is totally unstructured too, so children can be as free as they like to explore and adapt the game or activity. They can create their own little environment and immerse themselves in their own new world. Their imaginations are set free and opportunities to be creative will come naturally. As we can see above, during quiet time, children can engage in activities that they have chosen for themselves. This can greatly help them to become more independent and self-reliant. That’s a great skill for them to develop as they approach the time to transition to school. There, they will need to rely much more on such skills.

As we can see above, during quiet time, children can engage in activities that they have chosen for themselves. This can greatly help them to become more independent and self-reliant. That’s a great skill for them to develop as they approach the time to transition to school. There, they will need to rely much more on such skills. When you first introduce quiet time to your child, start slowly and begin with short periods each day. This can be increased as your little one gets used to it.

When you first introduce quiet time to your child, start slowly and begin with short periods each day. This can be increased as your little one gets used to it.

In today’s post, we explore the benefits of using positive language around under-fives. All too often, it’s tempting to say ‘No!’, ‘Stop that!’ or even ‘Don’t Eat That!’ and similar around little ones. This is particularly true when you want them to cease the offending activity urgently or are simply exhausted if it’s been a challenging day. There are good reasons for such negative commands, of course, not least that of their safety in many cases. However, such commands can sound stern and cause stress for the little ones. What’s more, if a child hears too much negative language and cannot understand why they’re not allowed to do a particular thing, problems can begin to arise and, indeed, the issue can become insidious. It may even result in worsening behaviour. Let’s explore, therefore, the issues around negative language and the simple solution that’s available in the form of positive language.

In today’s post, we explore the benefits of using positive language around under-fives. All too often, it’s tempting to say ‘No!’, ‘Stop that!’ or even ‘Don’t Eat That!’ and similar around little ones. This is particularly true when you want them to cease the offending activity urgently or are simply exhausted if it’s been a challenging day. There are good reasons for such negative commands, of course, not least that of their safety in many cases. However, such commands can sound stern and cause stress for the little ones. What’s more, if a child hears too much negative language and cannot understand why they’re not allowed to do a particular thing, problems can begin to arise and, indeed, the issue can become insidious. It may even result in worsening behaviour. Let’s explore, therefore, the issues around negative language and the simple solution that’s available in the form of positive language. Sometimes, though, constantly hearing ‘no’ can spark tantrums, particularly if a child doesn’t understand the reason they are not allowed to do something. They can feel particularly frustrated when they receive a succession of negative commands and, in the end, may feel they simply can’t do anything right. This can lead not only to stress for them, but also to possible low self-esteem. Furthermore, if they hear ‘no’ and other negative language too often, they can begin to ‘tune out’ to it. They could then go on to develop challenging behaviour due to this, their confusion and frustration. Stress levels can then rise for the parent too, the infant can pick up on this and it can become a real vicious circle. It doesn’t have to be that way, though …

Sometimes, though, constantly hearing ‘no’ can spark tantrums, particularly if a child doesn’t understand the reason they are not allowed to do something. They can feel particularly frustrated when they receive a succession of negative commands and, in the end, may feel they simply can’t do anything right. This can lead not only to stress for them, but also to possible low self-esteem. Furthermore, if they hear ‘no’ and other negative language too often, they can begin to ‘tune out’ to it. They could then go on to develop challenging behaviour due to this, their confusion and frustration. Stress levels can then rise for the parent too, the infant can pick up on this and it can become a real vicious circle. It doesn’t have to be that way, though …

Today’s post will appeal to families who are finding the current financial climate particularly challenging. With energy costs and inflation so high, the following may represent a welcome piece of good news. Today we highlight the many Baby Banks that are popping up all around the UK and explain how they can help struggling families, all for free.

Today’s post will appeal to families who are finding the current financial climate particularly challenging. With energy costs and inflation so high, the following may represent a welcome piece of good news. Today we highlight the many Baby Banks that are popping up all around the UK and explain how they can help struggling families, all for free. A Baby bank is a similar concept to a food bank. However, instead of food and drink, it provides second-hand clothing, toys and equipment for babies, under-fives and often even for children up to the age of 16 in some cases. Baby Banks can also be compared to a charity shop, however, with baby banks, everything is free.

A Baby bank is a similar concept to a food bank. However, instead of food and drink, it provides second-hand clothing, toys and equipment for babies, under-fives and often even for children up to the age of 16 in some cases. Baby Banks can also be compared to a charity shop, however, with baby banks, everything is free. Baby Banks are run by all sorts of different people and organisations and therefore the rules around actually getting ones hands on the free items vary from Baby Bank to Baby Bank. Some accept requests for items directly from families themselves. Others only deal via a referral from some kind of professional. Examples include social workers, family support agencies, teachers, family centres, health visitors, medical professionals, food banks and women’s refuges. So, once you have located your nearest Baby Bank, you will need to check whether they will deal with you directly or only through such a referral. Either way, you will usually need to agree a time and date for collection of your item with the Baby Bank (you can’t usually just turn up, although there are exceptions). Not all Baby Banks are open all week and that’s another reason to check with Baby Banks or their websites first.

Baby Banks are run by all sorts of different people and organisations and therefore the rules around actually getting ones hands on the free items vary from Baby Bank to Baby Bank. Some accept requests for items directly from families themselves. Others only deal via a referral from some kind of professional. Examples include social workers, family support agencies, teachers, family centres, health visitors, medical professionals, food banks and women’s refuges. So, once you have located your nearest Baby Bank, you will need to check whether they will deal with you directly or only through such a referral. Either way, you will usually need to agree a time and date for collection of your item with the Baby Bank (you can’t usually just turn up, although there are exceptions). Not all Baby Banks are open all week and that’s another reason to check with Baby Banks or their websites first. Absolutely! Baby Banks rely on the generous donations from families that no long require their baby clothes or equipment. Perhaps the child has grown out of them and the items are still in good condition, or perhaps they were an unwanted gift. Donating items is also a great way to declutter and to make space in the home, as well as helping others. However, before donating to a Baby Bank, always check with them to see if all your proposed items are required and, as before, ensure you know whether an appointment is needed or whether you can just turn up with your items. Certain rules may also apply around the condition and type of items (this varies depending upon which Baby Bank you are dealing with). Baby car seats and electronic items may also have special rules due to the extra safety considerations.

Absolutely! Baby Banks rely on the generous donations from families that no long require their baby clothes or equipment. Perhaps the child has grown out of them and the items are still in good condition, or perhaps they were an unwanted gift. Donating items is also a great way to declutter and to make space in the home, as well as helping others. However, before donating to a Baby Bank, always check with them to see if all your proposed items are required and, as before, ensure you know whether an appointment is needed or whether you can just turn up with your items. Certain rules may also apply around the condition and type of items (this varies depending upon which Baby Bank you are dealing with). Baby car seats and electronic items may also have special rules due to the extra safety considerations.

Are you a student as well as a parent? If so, there are several Government schemes that offer help with childcare costs, some of which will save student parents substantial amounts of money. By doing so, they also make the prospect of juggling parenthood with being a student much more manageable. Today we examine the key childcare funding options, including how the type of course and the age of the parent affect eligibility.

Are you a student as well as a parent? If so, there are several Government schemes that offer help with childcare costs, some of which will save student parents substantial amounts of money. By doing so, they also make the prospect of juggling parenthood with being a student much more manageable. Today we examine the key childcare funding options, including how the type of course and the age of the parent affect eligibility. The very generous Student Childcare Grant is available for eligible students who who are studying full-time on a higher education course and have dependent children aged 14 or under (16 or under if they have special needs).

The very generous Student Childcare Grant is available for eligible students who who are studying full-time on a higher education course and have dependent children aged 14 or under (16 or under if they have special needs). If you are aged 20 or over, are a parent studying in further education for a qualification on a Level 3 course or below and are facing financial hardship, you may be eligible for childcare funding under the Learner Support scheme. This funding could help you with childcare and other study-related costs if you fit the right eligibility criteria.

If you are aged 20 or over, are a parent studying in further education for a qualification on a Level 3 course or below and are facing financial hardship, you may be eligible for childcare funding under the Learner Support scheme. This funding could help you with childcare and other study-related costs if you fit the right eligibility criteria. If you are a parent as well as a student aged under 20 when you begin one of a range of publicly-funded courses in England, you may be eligible for childcare funding through the Care to Learn bursary scheme. If eligible, you could claim as much as £175 in childcare per week, per child if you live in London, reducing to £160 per week, per child, outside London.

If you are a parent as well as a student aged under 20 when you begin one of a range of publicly-funded courses in England, you may be eligible for childcare funding through the Care to Learn bursary scheme. If eligible, you could claim as much as £175 in childcare per week, per child if you live in London, reducing to £160 per week, per child, outside London.